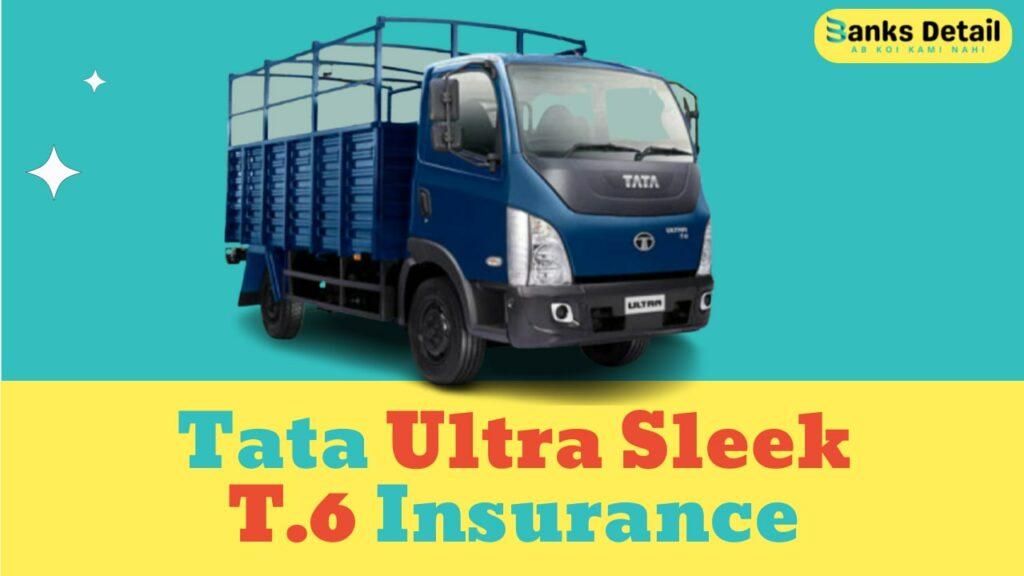

Get Insured: Tata Ultra Sleek T.6 Insurance – Protect Your Ride!

Introduction

The Tata Ultra Sleek T.6 is a high-performance commercial truck known for its exceptional features and capabilities.

Designed to meet the demanding needs of businesses, this truck offers impressive mileage, robust specifications, and a competitive on-road price.

However, alongside the advantages of owning a Tata Ultra Sleek T.6, it is vital to recognize the significance of insurance coverage for commercial vehicles.

Insurance provides essential protection against potential risks, accidents, and unforeseen damages, ensuring the security and financial well-being of both the truck and its owner.

Understanding Tata Ultra Sleek T.6 Insurance

Tata Ultra Sleek T.6 Insurance refers to the specialized insurance coverage designed specifically for the Tata Ultra Sleek T.6 commercial truck.

It provides comprehensive protection against various risks and liabilities that may arise during the operation of the truck.

This insurance coverage is crucial for owners of the Tata Ultra Sleek T.6 as it offers financial security and peace of mind in the event of accidents, damages, theft, or other unforeseen incidents.

Why is Tata Ultra Sleek T.6 Insurance Necessary?

Tata Ultra Sleek T.6 Insurance is necessary for several reasons. Firstly, commercial vehicles like the Tata Ultra Sleek T.6 are exposed to a higher level of risk due to their extensive use on roads and highways.

Accidents, collisions, and damages are potential risks that can result in significant financial loss. Having insurance coverage ensures that the owner is protected from the financial burden that may arise from such incidents.

Secondly, Tata Ultra Sleek T.6 Insurance is necessary to comply with legal requirements. In many jurisdictions, it is mandatory to have insurance coverage for commercial vehicles.

By obtaining the appropriate insurance policy, owners of the Tata Ultra Sleek T.6 can ensure compliance with the law and avoid potential penalties or legal consequences.

Key Benefits and Advantages of Tata Ultra Sleek T.6 Insurance

Having Tata Ultra Sleek T.6 Insurance offers several key benefits and advantages. These include:

- Financial Protection: Tata Ultra Sleek T.6 Insurance provides financial protection against a wide range of risks. In the event of accidents, damages, or theft, insurance coverage helps mitigate the financial impact by covering repair costs, replacement expenses, or compensation to third parties.

- Peace of Mind: With Tata Ultra Sleek T.6 Insurance, owners can have peace of mind knowing that their valuable commercial truck is adequately protected. The insurance coverage relieves owners of the worry and stress associated with potential financial liabilities and losses.

- Legal Compliance: Tata Ultra Sleek T.6 Insurance ensures compliance with legal requirements. By obtaining the necessary insurance coverage, owners can fulfill their legal obligations and avoid potential legal penalties or consequences.

- Protection for Third-Party Liabilities: Tata Ultra Sleek T.6 Insurance includes third-party liability coverage. This means that if the insured vehicle causes damage to someone else’s property or causes bodily injury to a third party, the insurance coverage provides financial protection by covering the related legal and compensation costs.

Common Misconceptions or Myths about Truck Insurance Coverage

There are some common misconceptions or myths surrounding truck insurance coverage, including Tata Ultra Sleek T.6 Insurance.

These misconceptions can lead to misunderstandings or misinterpretations of insurance policies. Some of these myths include:

- Personal Auto Insurance Covers Commercial Trucks: It is a misconception to assume that personal auto insurance policies automatically cover commercial trucks like the Tata Ultra Sleek T.6. Commercial vehicles typically require specialized insurance coverage tailored to their unique risks and usage.

- Insurance is Expensive and Unaffordable: While insurance costs can vary depending on several factors, including the type of vehicle, coverage options, and risk factors, there are often affordable insurance plans available for commercial trucks like the Tata Ultra Sleek T.6. It is important to explore different insurance providers and policy options to find coverage that suits both budget and needs.

- Insurance Claims Always Lead to Higher Premiums: Another myth is that filing insurance claims will always result in increased insurance premiums. While multiple claims or at-fault accidents can impact premiums, many insurance providers offer claim forgiveness or have policies in place to prevent significant premium hikes for first-time or non-fault claims.

Understanding these misconceptions can help Tata Ultra Sleek T.6 owners make informed decisions when selecting insurance coverage and avoid common misunderstandings about truck insurance.

Coverage Options for Tata Ultra Sleek T.6 Insurance

When it comes to Tata Ultra Sleek T.6 Insurance, there are various coverage options available to suit the specific needs and requirements of Tata Ultra Sleek T.6 truck owners.

Understanding these options is essential for selecting the most appropriate coverage for your truck. The key coverage options for Tata Ultra Sleek T.6 Insurance include:

- Comprehensive Coverage: Comprehensive coverage is a robust insurance option that provides extensive protection for your Tata Ultra Sleek T.6 truck. It covers a wide range of risks, including accidents, collisions, damages due to natural disasters, fire, theft, and vandalism. With comprehensive coverage, you can have peace of mind knowing that your vehicle is protected from a wide array of potential damages.

- Third-Party Liability Coverage: Third-party liability coverage is an essential component of Tata Ultra Sleek T.6 Insurance. This coverage provides legal protection in situations where your truck causes damage to someone else’s property or causes bodily injury to a third party. It covers the costs of legal defense and compensation claims, safeguarding you from financial liabilities.

- Additional Coverage Options: Apart from comprehensive and third-party liability coverage, Tata Ultra Sleek T.6 Insurance offers additional coverage options tailored to specific needs. These additional coverage options provide niche coverage for specialized requirements, such as coverage for specific cargo or equipment carried by your Tata Ultra Sleek T.6 truck. These options can be customized to match your unique business needs and ensure that you have comprehensive protection for your valuable assets.

It is crucial to review these coverage options carefully and consider your specific circumstances when selecting Tata Ultra Sleek T.6 Insurance.

By choosing the right combination of coverage options, you can tailor your insurance policy to adequately protect your Tata Ultra Sleek T.6 against potential risks, damages, and liabilities.

Factors Affecting Tata Ultra Sleek T.6 Insurance Premiums

The cost of Tata Ultra Sleek T.6 Insurance premiums is influenced by several key factors. Insurance providers consider these factors when determining the premium amount for your policy.

Understanding these factors can help you make informed decisions about your insurance coverage. The main factors that affect Tata Ultra Sleek T.6 Insurance premiums include:

- Vehicle-related Factors:

- Age of the Vehicle: The age of your Tata Ultra Sleek T.6 truck is a significant factor that impacts insurance premiums. Generally, newer trucks may have lower premiums compared to older ones due to their advanced safety features and better overall condition.

- Model and Value: The specific model and value of your Tata Ultra Sleek T.6 truck are taken into account. Trucks with higher values may have higher premiums since the potential costs of repairs or replacements are higher.

- Modifications: Any modifications made to your Tata Ultra Sleek T.6, such as engine enhancements or customizations, can affect premiums. Certain modifications may increase the risk associated with the vehicle, leading to higher insurance costs.

- Driver-related Factors:

- Experience: The driver’s level of experience plays a role in determining insurance premiums. More experienced drivers who have a proven track record of safe driving may be eligible for lower premiums compared to less experienced drivers.

- Driving History: Insurance providers consider the driver’s past driving history, including any traffic violations, accidents, or claims made. A clean driving record with no history of accidents or violations can result in lower premiums.

- Qualifications: The qualifications of the driver, such as completion of defensive driving courses or possessing a commercial driver’s license (CDL), may impact insurance premiums. Additional qualifications can demonstrate a commitment to safe driving practices, potentially leading to lower premiums.

- Geographical Factors:

- Location: The location where your Tata Ultra Sleek T.6 truck is primarily operated plays a role in determining premiums. Areas with higher rates of accidents, theft, or vandalism may have higher premiums compared to areas with lower risk.

- Routes: The routes you frequently take with your truck can impact insurance premiums. Routes that are considered higher risk, such as busy highways or areas prone to accidents, may result in higher premiums.

- Risk Assessment: Insurance providers conduct a risk assessment based on historical data and statistical analysis. Factors like crime rates, weather patterns, and the overall risk profile of the area can influence insurance premiums.

When obtaining Tata Ultra Sleek T.6 Insurance, it’s important to provide accurate and up-to-date information about your vehicle, driving history, and other relevant details.

This allows insurance providers to accurately assess the risk associated with insuring your Tata Ultra Sleek T.6 truck and provide you with appropriate coverage at a fair premium rate.

Tata Ultra Sleek T.6 Insurance Premiums and Discounts

When it comes to Tata Ultra Sleek T.6 Insurance, the premiums you pay for your insurance coverage can be influenced by various factors.

Understanding these factors and exploring ways to lower your premiums can help you optimize your insurance costs.

Here are some key factors that influence Tata Ultra Sleek T.6 Insurance premiums and ways to potentially reduce them:

- Maintain a Good Driving Record: Insurance providers consider your driving history and track record when determining premiums. Maintaining a clean driving record with no accidents or traffic violations demonstrates responsible driving behavior and can help lower your premiums. Safe driving practices can have a positive impact on your insurance costs.

- Install Safety and Security Devices: Equipping your Tata Ultra Sleek T.6 truck with advanced safety and security devices can help reduce the risk of accidents, theft, or vandalism. Insurance providers may offer discounts for vehicles equipped with features such as anti-lock braking systems (ABS), airbags, alarm systems, GPS tracking devices, or immobilizers. Installing these devices not only enhances the safety of your truck but also demonstrates your commitment to risk reduction, potentially leading to lower premiums.

- Bundle Multiple Insurance Policies: Bundling multiple insurance policies, such as your Tata Ultra Sleek T.6 Insurance and other insurance needs (e.g., personal auto, home, or business insurance), with the same insurance provider can often result in discounts. Insurance companies may offer reduced premiums when you consolidate your insurance policies with them. This bundling can simplify your insurance management and provide cost savings.

It’s important to discuss these factors with your insurance provider and explore the available discounts or cost-saving options specific to Tata Ultra Sleek T.6 Insurance.

Each insurance provider may have its own set of discounts and criteria for eligibility.

By actively implementing risk-reducing measures, maintaining a good driving record, and taking advantage of applicable discounts, you can potentially lower your Tata Ultra Sleek T.6 Insurance premiums while still maintaining comprehensive coverage for your commercial truck.

Filing a Claim with Tata Ultra Sleek T.6 Insurance: A Step-by-Step Guide

In the unfortunate event of an accident or damage to your Tata Ultra Sleek T.6 truck, it is essential to know the process for filing a claim with your Tata Ultra Sleek T.6 Insurance.

Here is a step-by-step guide to help you navigate the claim process effectively:

- Notify your Insurance Provider: As soon as possible after the incident, contact your Tata Ultra Sleek T.6 Insurance provider to report the claim. Promptly notifying your insurer is crucial, as they can guide you through the subsequent steps and provide necessary instructions. Be prepared to provide details about the accident, damages, and any injuries sustained.

- Document the Damages: Take photographs or videos of the damages to your Tata Ultra Sleek T.6 truck. Visual documentation serves as crucial evidence for your claim. Capture multiple angles and close-ups to provide a comprehensive view of the damages. Additionally, gather any other relevant documentation, such as police reports, witness statements, or any supporting evidence related to the incident.

- Communicate with your Insurer: Maintain open and regular communication with your insurance company throughout the claim process. Ensure you provide all the required information promptly and accurately. Be prepared to answer any questions and provide additional documentation as requested by your insurer. Promptly respond to any inquiries or requests for clarification to avoid delays in processing your claim.

- Professional Assessment: Your Tata Ultra Sleek T.6 Insurance provider will arrange for a professional assessment of the damages to your truck. An insurance adjuster will evaluate the extent of the damages and assess the costs involved in repairing or replacing the damaged parts. The adjuster will work with you to determine the next steps in the claim process based on the terms and conditions of your policy.

- Claim Settlement: Once the assessment is complete, your insurance provider will initiate the claim settlement process. They will review the details of your policy, the assessment report, and any supporting documentation to determine the coverage and compensation applicable to your claim. Based on their evaluation, your insurer will provide a settlement offer that takes into account the deductible and the covered damages.

It’s important to review the settlement offer carefully and seek clarification from your insurer if needed. If you agree with the settlement, your insurer will process the payment to cover the eligible damages.

If there are any disagreements or disputes regarding the settlement, you can work with your insurer to find a resolution, including the possibility of mediation or arbitration.

Remember, throughout the claim process, maintain detailed records of all communications, including phone calls, emails, and letters exchanged with your insurer.

Being organized and proactive will help ensure a smoother and more efficient claim process.

Lesser-Known Benefits of Tata Ultra Sleek T.6 Insurance

In addition to the primary coverage provided by Tata Ultra Sleek T.6 Insurance, there are some lesser-known benefits that can add further value to your insurance policy.

These benefits are often not widely known but can be advantageous in specific situations. Here are some uncommon or lesser-known benefits associated with Tata Ultra Sleek T.6 Insurance:

- Roadside Assistance and Emergency Services: Some Tata Ultra Sleek T.6 Insurance policies include roadside assistance and emergency services. In the event of a breakdown, flat tire, battery failure, or other roadside emergencies, this benefit provides you with access to professional assistance. It ensures that help is just a phone call away, offering convenience, peace of mind, and minimizing disruptions to your business operations.

- Alternative Transportation Coverage: Certain Tata Ultra Sleek T.6 Insurance policies may offer coverage for alternative transportation or rental trucks. If your Tata Ultra Sleek T.6 requires repairs after an accident, this benefit can provide coverage for the cost of a temporary replacement vehicle. This ensures that your business can continue its operations without significant interruptions while your truck is being repaired.

- Value-Added Services: Some insurance providers offer value-added services to policyholders. These services may include driver training programs to enhance the skills and safety of your drivers. Additionally, some providers offer fleet management solutions, providing tools and resources to help you optimize the efficiency and performance of your Tata Ultra Sleek T.6 truck fleet. These value-added services can contribute to improved operations and better overall management of your commercial vehicle.

It’s important to review the specific terms and conditions of your Tata Ultra Sleek T.6 Insurance policy to understand the availability and extent of these lesser-known benefits.

Take advantage of these additional features to maximize the value and protection offered by your insurance coverage.

They can provide added convenience, peace of mind, and support in unexpected situations, ultimately contributing to a more positive ownership experience with your Tata Ultra Sleek T.6 truck.

Frequently Asked Questions (FAQs) About Tata Ultra Sleek T.6 Insurance

Is Tata Ultra Sleek T.6 Insurance mandatory?

Yes, it is mandatory to have insurance coverage for your Tata Ultra Sleek T.6 truck as per legal requirements. Having insurance provides financial protection and ensures compliance with the law.

What does Tata Ultra Sleek T.6 Insurance cover?

Tata Ultra Sleek T.6 Insurance offers comprehensive coverage for your commercial truck. It includes protection against accidents, damages, theft, third-party liabilities, and additional coverage options for niche needs.

Can I lower my Tata Ultra Sleek T.6 Insurance premiums?

Yes, you can potentially lower your premiums by maintaining a good driving record, installing safety and security devices, and bundling multiple insurance policies. These factors can qualify you for discounts and reduce your insurance costs.

How do I file a claim with Tata Ultra Sleek T.6 Insurance?

To file a claim, notify your insurance provider as soon as possible after the incident. Document the damages, communicate with your insurer, and cooperate fully throughout the claim process. A professional assessment will be conducted, and a claim settlement will be reached based on the terms of your policy.

Are there any lesser-known benefits of Tata Ultra Sleek T.6 Insurance?

Yes, Tata Ultra Sleek T.6 Insurance offers lesser-known benefits such as roadside assistance and emergency services, alternative transportation coverage, and value-added services like driver training programs or fleet management solutions. These benefits provide added convenience and support in unexpected situations.

Can I customize my Tata Ultra Sleek T.6 Insurance coverage?

Yes, Tata Ultra Sleek T.6 Insurance offers customization options. You can select additional coverage options based on your specific needs, such as cargo or equipment coverage. This allows you to tailor your insurance policy to adequately protect your valuable assets.

How do I choose the right Tata Ultra Sleek T.6 Insurance coverage?

To choose the right coverage, assess your requirements, and consider factors like the age and value of your truck, your driving history, and geographical factors. Consult with insurance providers, compare coverage options, and seek guidance to make an informed decision.

Can I transfer my Tata Ultra Sleek T.6 Insurance to a new owner?

Yes, Tata Ultra Sleek T.6 Insurance can be transferred to a new owner. However, the transfer process and any applicable terms and conditions may vary among insurance providers. Contact your insurance company to understand the requirements and procedures for transferring the insurance policy.

What should I do in case of a claim dispute?

If you have a dispute regarding a claim, communicate with your insurance provider to address your concerns. They may provide options for resolution, including mediation or arbitration, to reach a satisfactory outcome.

How often should I review my Tata Ultra Sleek T.6 Insurance policy?

It is recommended to review your Tata Ultra Sleek T.6 Insurance policy annually or whenever there are significant changes in your circumstances, such as modifications to the truck or changes in usage. Regular reviews ensure that your coverage remains adequate and up-to-date.

Conclusion

In conclusion, Tata Ultra Sleek T.6 Insurance is of paramount importance for owners of this commercial truck. It provides comprehensive coverage against risks, damages, and liabilities, ensuring peace of mind and financial protection.

As you consider Tata Ultra Sleek T.6 Insurance, it is essential to explore the different coverage options available and make an informed decision based on your specific needs.

By choosing the right coverage, you can tailor the insurance policy to safeguard your valuable asset effectively.

With Tata Ultra Sleek T.6 Insurance, you can enjoy the confidence of knowing that you are protected, allowing you to focus on your business and daily operations with a sense of security.

Read More About:- Insurance, Commercial Vehicle Insurance, Truck Insurance, Tata Ultra Sleek T.6