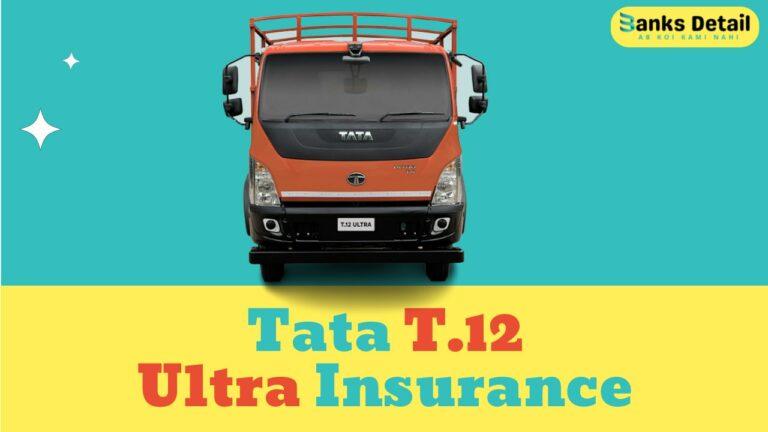

Get the Best Tata T.16 Ultra SL Insurance Rates Today!

Introduction

The Tata T.16 Ultra SL truck stands as a prominent player in the commercial transportation industry, renowned for its robustness, reliability, and impressive payload capacity.

As businesses heavily rely on these trucks for logistics and freight transport, it becomes paramount to safeguard their operations with comprehensive insurance coverage.

In this fast-paced and unpredictable industry, Tata T.16 Ultra SL insurance provides vital protection against potential risks, including accidents, theft, damages, and third-party liabilities.

Embracing this insurance is not only a prudent business decision but also a shield that ensures smooth and secure operations for all stakeholders involved.

Understanding Tata T.16 Ultra SL Insurance

What is Tata T.16 Ultra SL Insurance?

Tata T.16 Ultra SL Insurance refers to a specialized insurance policy designed explicitly for the Tata T.16 Ultra SL commercial truck model. This insurance coverage offers comprehensive protection to the truck owner against various risks and potential financial losses.

Coverage options tailored for this specific truck model

Tata T.16 Ultra SL insurance provides a range of coverage options specifically tailored to address the unique risks associated with operating this commercial truck. The coverage options may include:

- Comprehensive Coverage: This all-encompassing option safeguards the Tata T.16 Ultra SL from damages caused by collisions, non-collision incidents like theft, fire, natural disasters, and vandalism. It provides extensive protection, ensuring businesses can operate with peace of mind.

- Third-Party Liability Coverage: This crucial coverage protects businesses from legal and financial consequences if the Tata T.16 Ultra SL is involved in an accident that causes property damage or bodily injuries to third parties. It helps in mitigating potential lawsuits and financial burdens.

- Cargo Protection Insurance: Tata T.16 Ultra SL insurance may offer add-on coverage specifically designed to protect the goods being transported in the truck. Cargo protection insurance ensures that the valuable cargo is safeguarded against damage or loss during transit, bolstering trust among customers.

Key benefits of having insurance for Tata T.16 Ultra SL

Having insurance for the Tata T.16 Ultra SL comes with several significant advantages for businesses:

- Financial Security: Tata T.16 Ultra SL insurance provides financial security to business owners in the event of an unforeseen accident, theft, or other covered incidents. It helps businesses avoid bearing the entire financial burden themselves.

- Compliance: Commercial vehicle insurance is often a legal requirement in many regions. Having Tata T.16 Ultra SL insurance ensures compliance with regulations and avoids potential penalties.

- Continuity of Operations: In the event of an accident or theft, having insurance coverage ensures that the business can quickly recover and resume operations, minimizing downtime and potential revenue losses.

- Protection against Liabilities: Third-party liability coverage protects businesses from the financial repercussions of causing damage or injury to others, maintaining a positive reputation and trust within the industry.

The Importance of Commercial Vehicle Insurance

An in-depth explanation of why commercial truck insurance is crucial

Commercial truck insurance, including Tata T.16 Ultra SL insurance, is of paramount importance due to several reasons:

- Risk Management: Commercial trucks are exposed to various risks on the road, including accidents, theft, and natural disasters. Insurance acts as a crucial risk management tool, offering financial protection against these uncertainties.

- Legal Compliance: In many jurisdictions, commercial vehicle insurance is mandated by law. Operating a Tata T.16 Ultra SL without insurance can lead to legal penalties and business disruptions.

- Financial Protection: Accidents involving commercial trucks can result in substantial financial liabilities, including property damage, medical expenses, and legal costs. Insurance coverage provides a safety net, minimizing the financial impact on the business.

- Peace of Mind: For business owners, having Tata T.16 Ultra SL insurance brings peace of mind, knowing that their valuable assets are protected, and they can focus on their core operations without constant worry about potential risks.

Having a comprehensive commercial vehicle insurance policy like Tata T.16 Ultra SL insurance is a prudent decision that not only safeguards businesses but also ensures a smooth and secure operation in the dynamic commercial transportation industry.

Exploring Insurance Options for Tata T.16 Ultra SL

Comprehensive Coverage

Comprehensive insurance for Tata T.16 Ultra SL is a robust and all-encompassing policy that offers extensive protection to the commercial truck and its owner.

This coverage is often referred to as “all-risk insurance,” “full coverage insurance,” or “total protection insurance,” highlighting its comprehensive nature.

Advantages of Comprehensive Coverage for Tata T.16 Ultra SL

- Protection against Accidents: Comprehensive coverage includes protection against damages caused by collisions, whether it’s a minor fender bender or a major accident. It ensures that repair costs are covered, enabling businesses to resume operations swiftly.

- Theft Coverage: Tata T.16 Ultra SL insurance provides coverage in case of theft, offering financial relief in the unfortunate event of the truck being stolen. It allows businesses to recover the loss and replace the truck promptly.

- Fire and Natural Disasters: Comprehensive insurance extends coverage to damages caused by fire and natural disasters, such as floods, hurricanes, and earthquakes. This safeguard is essential, especially when operating in regions prone to such events.

- Vandalism Protection: Tata T.16 Ultra SL insurance under comprehensive coverage includes protection against vandalism. It covers damages resulting from intentional acts of damage to the truck.

Third-Party Liability Coverage

Third-party liability insurance is of utmost importance for commercial trucks like Tata T.16 Ultra SL, as they are often involved in road accidents. This coverage protects businesses from the legal and financial consequences of causing damage or injury to third parties.

How Third-Party Liability Coverage Protects Businesses

- Property Damage Insurance: In case the Tata T.16 Ultra SL is involved in an accident that causes damage to someone else’s property, this insurance coverage takes care of the associated costs, including repairs and replacements.

- Bodily Injury Insurance: If the accident results in injuries to other individuals, third-party liability insurance covers the medical expenses, rehabilitation costs, and potential legal fees arising from bodily injury claims.

- Public Liability Insurance: Public liability insurance is an essential component of third-party liability coverage. It protects businesses from claims made by members of the public who may suffer losses or injuries due to the Tata T.16 Ultra SL’s operations.

Cargo Protection Insurance

Tata T.16 Ultra SL insurance also offers a unique add-on known as cargo protection coverage. This aspect of the insurance policy is tailored to safeguard the goods being transported in the truck.

Safeguarding the Cargo

- Goods in Transit Insurance: This aspect of cargo protection insurance covers the goods while they are in transit, protecting businesses from financial losses in case of damage or loss during transportation.

- Freight Protection Insurance: Freight protection insurance ensures that businesses are reimbursed for the value of the goods being transported, allowing them to fulfill their contractual obligations even if the cargo is lost or damaged.

- Cargo Damage Coverage: In the event of accidental damage to the cargo during loading, unloading, or transportation, cargo protection insurance covers the repair or replacement costs, preventing financial strain on the business.

Choosing the right insurance coverage for Tata T.16 Ultra SL, including comprehensive, third-party liability, and cargo protection, is essential to ensure the smooth and secure operation of the commercial truck and the overall success of the business.

These specialized insurance options provide valuable protection against various risks, allowing businesses to focus on their core operations with confidence.

Factors Affecting Tata T.16 Ultra SL Insurance Premiums

Vehicle Specifications

The truck’s specifications play a significant role in determining Tata T.16 Ultra SL insurance premiums. Insurers consider various factors related to the truck’s design and technical details when assessing the level of risk associated with insuring it.

Impact of Truck’s Specifications on Insurance Premiums

- Vehicle Value: The market value of the Tata T.16 Ultra SL is a critical factor. Higher-value trucks may have higher insurance premiums as their repair or replacement costs are more substantial.

- Engine Size and Power: Trucks with larger engines or higher horsepower might be considered riskier to insure, leading to higher premiums due to their potential for increased speed and power.

- Payload Capacity: The maximum payload capacity of the Tata T.16 Ultra SL is also considered. Trucks with higher payload capacities may face greater risks and thus higher insurance costs.

- Safety Features: The presence of advanced safety features in the Tata T.16 Ultra SL can have a positive impact on insurance premiums. Features like airbags, anti-lock braking systems (ABS), and electronic stability control (ESC) may result in lower premiums as they reduce the risk of accidents and injuries.

- Anti-Theft Measures: The presence of anti-theft devices and tracking systems can lower insurance costs. These security measures help in reducing the risk of theft, making the truck less susceptible to losses.

Usage and Mileage

The frequency of usage and annual mileage of the Tata T.16 Ultra SL significantly influence insurance rates. Insurers consider how often and how far the truck is driven each year when calculating premiums.

Influence of Usage and Mileage on Insurance Rates

- High Usage: Trucks that are on the road frequently are at a higher risk of accidents and damages. As a result, higher usage can lead to higher insurance premiums.

- Annual Mileage: The more miles the Tata T.16 Ultra SL travels each year, the more exposure it has to potential risks. Insurers may charge higher premiums for trucks with higher annual mileage.

Tips for Managing Mileage to Lower Premiums

- Optimize Routes: Efficient route planning can help reduce mileage while maintaining productivity. Using GPS tracking and logistics software can aid in finding the most efficient paths for deliveries.

- Consolidate Shipments: Combining multiple shipments into a single trip can help reduce overall mileage, leading to potential cost savings on insurance premiums.

- Regular Maintenance: Proper truck maintenance ensures the Tata T.16 Ultra SL operates at its best, reducing the likelihood of breakdowns and costly repairs.

Driver Experience and Record

The experience and driving records of the operators handling the Tata T.16 Ultra SL have a significant impact on insurance costs. Insurers assess the risk associated with the drivers’ capabilities and track record.

Significance of Driver Experience and Record on Insurance Costs

- Safe Driving History: Drivers with clean records, free from accidents and traffic violations, are considered lower risk by insurers. Businesses with experienced and responsible drivers may benefit from lower insurance premiums.

- Accident History: A history of accidents involving the Tata T.16 Ultra SL may increase insurance costs. Insurers consider the frequency and severity of past accidents when determining premiums.

- Training and Certification: Providing driver training and ensuring proper certifications can demonstrate a commitment to safety, potentially leading to more favorable insurance rates.

By understanding how vehicle specifications, usage, mileage, and driver records influence insurance premiums, businesses can make informed decisions to optimize coverage and potentially lower insurance costs for their Tata T.16 Ultra SL trucks.

Implementing safety measures and promoting responsible driving practices can lead to a positive impact on insurance premiums, safeguarding both the business’s interests and the well-being of its commercial trucking operations.

Claim Process and Settlement

Step-by-Step Guide to Filing Claims

Filing an insurance claim for Tata T.16 Ultra SL insurance involves a structured process to ensure timely and efficient resolution of incidents. Following this step-by-step guide can help businesses navigate the claim process smoothly:

- Assess the Situation: In the event of an accident, theft, or damage, assess the situation and ensure the safety of all parties involved. Take necessary precautions to prevent further damage or injuries.

- Contact Authorities: If necessary, report the incident to the appropriate authorities, such as the police, and obtain an official accident report or incident reference number.

- Notify Insurer: Contact your insurance provider as soon as possible to report the incident. Provide all relevant details, including the date, time, location, and a brief description of what happened.

- Gather Required Documents: To support your claim, gather all necessary documents, which may include:

- Policy documents and insurance ID card.

- Copy of the driver’s license and other driver details (if applicable).

- Accident report or reference number from the authorities.

- Photos or videos of the accident scene and damages.

- Any relevant receipts or invoices related to repairs or replacements.

- Provide Accurate Information: Ensure that all information provided to the insurer is accurate and complete. Inaccurate or misleading information could delay the claim process.

- Submit the Claim: Send all the required documents and information to your insurance provider through the specified channels. Be prompt in submitting the claim to expedite the settlement process.

- Claim Assessment: The insurance company will assess the claim and conduct any necessary investigations. They may send an adjuster to evaluate the damages and determine coverage.

- Claim Decision: After evaluating the claim, the insurance company will make a decision regarding coverage and the claim amount.

- Claim Settlement: If the claim is approved, the insurance company will proceed with the settlement process. They will either directly reimburse the amount or provide necessary assistance, as per the policy terms.

Timely Settlements

Importance of Prompt Claim Settlements for Businesses

Timely claim settlements hold immense significance for businesses operating Tata T.16 Ultra SL trucks. Quick resolution of claims can have several benefits:

- Business Continuity: Swift claim settlements allow businesses to repair or replace their damaged trucks promptly, ensuring minimal downtime and the continuity of operations.

- Financial Stability: Prompt settlements provide financial stability to businesses, avoiding cash flow disruptions and potential financial strains due to unexpected expenses.

- Customer Trust: Timely claim settlements help maintain the trust and confidence of customers. Reliable and efficient services enhance the reputation of the business.

Tips for Expediting the Claim Settlement Process

- Efficient Claim Processing: Choose an insurance provider known for their efficient and streamlined claim processing procedures. Look for companies with a track record of timely settlements.

- Minimizing Business Disruptions: Keep detailed records of the incident, including photographs, repair estimates, and invoices. This can help expedite the claim settlement process and minimize business disruptions.

- Cooperate with the Insurer: Cooperate fully with the insurance company during the claim assessment and investigation process. Provide all necessary information and documentation promptly.

By understanding the claim process and the importance of timely settlements, businesses can ensure a smooth and efficient resolution of incidents related to their Tata T.16 Ultra SL trucks.

Adhering to the step-by-step guide and following the tips for expediting claim settlements will enable businesses to effectively navigate the insurance claim process and maintain the smooth functioning of their commercial trucking operations.

Tips to Lower Tata T.16 Ultra SL Insurance Costs

- Utilizing Safety and Security Features: Equipping the Tata T.16 Ultra SL with advanced safety and security features can have a positive impact on insurance premiums. Insurers often offer discounts for trucks equipped with features such as airbags, anti-lock braking systems (ABS), electronic stability control (ESC), and GPS tracking devices. These features enhance the safety of the truck and reduce the risk of accidents and theft, making it less risky to insure.

- Negotiating with Insurers for Better Rates: Businesses should not hesitate to negotiate with insurance providers to obtain better rates. Insurance companies may be willing to offer discounts or customized packages for commercial truck insurance based on specific needs and requirements. Comparing quotes from multiple insurers and leveraging competitive offers can help businesses secure more favorable premiums for Tata T.16 Ultra SL insurance.

- Cost-Saving Strategies: Implementing cost-saving strategies can also contribute to reducing insurance expenses. Businesses can consider the following approaches:

- Deductibles: Opt for higher deductibles if financially feasible. A higher deductible means the business assumes a larger portion of the risk, leading to potentially lower insurance premiums.

- Fleet Insurance: If operating multiple Tata T.16 Ultra SL trucks, consider fleet insurance. Insuring all trucks under a single policy may lead to cost savings compared to insuring each truck separately.

- Claims History: Maintain a positive claims history by implementing safety measures and responsible driving practices. A good claims history can result in lower premiums over time.

- Regular Maintenance: Ensuring regular maintenance and inspections of the Tata T.16 Ultra SL demonstrates responsibility and can be perceived positively by insurers, possibly leading to lower insurance costs.

By incorporating safety and security features, engaging in negotiation with insurers, and implementing cost-saving strategies, businesses can effectively lower Tata T.16 Ultra SL insurance costs.

As insurance expenses are a significant aspect of commercial truck operations, these efforts can result in substantial savings while maintaining adequate insurance coverage for the truck and the business.

Less-Known Insurance Add-Ons for Tata T.16 Ultra SL

- GAP Insurance for Financing Protection: GAP insurance (Guaranteed Asset Protection) is a lesser-known add-on that provides crucial financing protection for businesses with Tata T.16 Ultra SL trucks on lease or loan. In the unfortunate event of total loss or theft of the truck, standard insurance coverage may not fully cover the outstanding loan or lease amount. GAP insurance bridges this gap and covers the difference between the truck’s market value and the remaining balance owed to the financing institution. This add-on ensures that businesses are not burdened with additional financial obligations in case of a substantial loss.

- Roadside Assistance Coverage for Emergencies: Roadside assistance coverage is an invaluable add-on for Tata T.16 Ultra SL owners, especially for those engaged in long-haul transportation. This add-on provides 24/7 support and assistance for various emergencies on the road, such as breakdowns, flat tires, battery jump-starts, and fuel delivery. Having roadside assistance coverage ensures that businesses can quickly resolve unforeseen roadside issues, minimizing downtime and avoiding potential revenue losses.

Benefits of Add-Ons

- Enhanced Protection: Less-known insurance add-ons like GAP insurance and roadside assistance coverage enhance the overall insurance protection for Tata T.16 Ultra SL trucks. These add-ons go beyond standard coverage, offering specific safeguards tailored to the unique needs of commercial trucking operations.

- Financial Security: Add-ons like GAP insurance provide an extra layer of financial security, safeguarding businesses from unexpected financial burdens in the event of significant losses or theft.

- Peace of Mind: Knowing that less-common risks and emergencies are covered by add-ons brings peace of mind to business owners. They can focus on their core operations, knowing that their valuable asset, the Tata T.16 Ultra SL, is well-protected.

- Customization: Add-ons allow businesses to customize their insurance policies to meet their specific requirements. They can choose the add-ons that best suit their operations, providing a tailored insurance solution.

- Competitive Advantage: Embracing less-known insurance add-ons may give businesses a competitive advantage in the industry. Offering additional protection and services to customers can build trust and loyalty, setting the business apart from competitors.

By considering and opting for less-known insurance add-ons like GAP insurance and roadside assistance coverage, businesses can ensure comprehensive protection for their Tata T.16 Ultra SL trucks.

These add-ons provide valuable benefits, bolstering financial security, and offering peace of mind for commercial truck owners.

Frequently Asked Questions (FAQs) About Tata T.16 Ultra SL Insurance

What is Tata T.16 Ultra SL Insurance?

Tata T.16 Ultra SL Insurance is a specialized insurance policy designed to provide comprehensive coverage for the Tata T.16 Ultra SL commercial truck. It offers protection against various risks, ensuring financial security for businesses operating this truck model.

What does Tata T.16 Ultra SL Insurance cover?

Tata T.16 Ultra SL Insurance typically covers damages from accidents, theft, fire, natural disasters, and vandalism. It may also include third-party liability coverage for property damage and bodily injuries, as well as cargo protection coverage for safeguarding goods in transit.

Are there add-ons available for Tata T.16 Ultra SL Insurance?

Yes, there are add-ons available to enhance the coverage of Tata T.16 Ultra SL Insurance. Some less-known add-ons include GAP insurance for financing protection and roadside assistance coverage for emergencies.

How can I lower Tata T.16 Ultra SL Insurance costs?

To lower insurance costs, businesses can consider utilizing safety and security features, negotiating with insurers for better rates, and implementing cost-saving strategies. Maintaining a good claims history and exploring fleet insurance options may also help in reducing premiums.

Is commercial vehicle insurance mandatory for Tata T.16 Ultra SL?

Yes, commercial vehicle insurance, including Tata T.16 Ultra SL Insurance, is often mandatory in many regions. Operating the truck without insurance could lead to legal penalties and business disruptions.

What documents are required to file a claim for Tata T.16 Ultra SL Insurance?

When filing a claim, businesses typically need to provide documents such as policy details, insurance ID card, driver’s license information, accident reports, photos or videos of damages, and any relevant receipts or invoices related to repairs or replacements.

How does Tata T.16 Ultra SL Insurance benefit businesses?

Tata T.16 Ultra SL Insurance provides financial security, compliance with legal requirements, and continuity of operations for businesses. It protects businesses from significant financial liabilities in case of accidents, theft, or damages, ensuring uninterrupted trucking operations.

Can I customize my Tata T.16 Ultra SL Insurance policy?

Yes, businesses can often customize their Tata T.16 Ultra SL Insurance policy by adding specific coverage options and add-ons to meet their unique requirements. Customization allows businesses to tailor their insurance to match their specific needs.

How can I expedite the claim settlement process for Tata T.16 Ultra SL Insurance?

To expedite claim settlements, businesses should promptly report incidents to the insurer, provide accurate information and all necessary documents, cooperate with the claim assessment process, and maintain a positive claims history.

Why should I consider Tata T.16 Ultra SL Insurance add-ons like GAP insurance and roadside assistance?

Tata T.16 Ultra SL Insurance add-ons like GAP insurance provide financing protection, covering outstanding loan or lease amounts in case of total loss or theft. Roadside assistance ensures 24/7 support for emergencies, minimizing downtime and ensuring prompt assistance on the road. These add-ons enhance overall protection and peace of mind for businesses operating the Tata T.16 Ultra SL.

Conclusion

In conclusion, Tata T.16 Ultra SL insurance stands as a critical safeguard for businesses operating in the commercial transportation industry.

With its robust coverage options tailored to this specific truck model, insurance provides comprehensive protection against various risks, including accidents, theft, third-party liabilities, and cargo damage.

As businesses heavily rely on the Tata T.16 Ultra SL for their logistics and freight transport needs, insurance becomes a crucial investment to ensure the continuity of operations and financial stability.

By making informed insurance choices, businesses can effectively protect their valuable assets and secure their place in the competitive market.

We encourage businesses to explore the various insurance options available, including less-known add-ons like GAP insurance and roadside assistance coverage, to tailor their policies according to their specific needs.

By utilizing safety and security features, negotiating for better rates, and implementing cost-saving strategies, businesses can optimize their insurance coverage while reducing overall insurance expenses.

Ultimately, Tata T.16 Ultra SL insurance provides the peace of mind necessary to navigate the challenges of the commercial trucking industry, enabling businesses to focus on their core operations and drive toward success with confidence.

Read More About:- Insurance, Commercial Vehicle Insurance, Truck Insurance, Tata T.16 Ultra SL