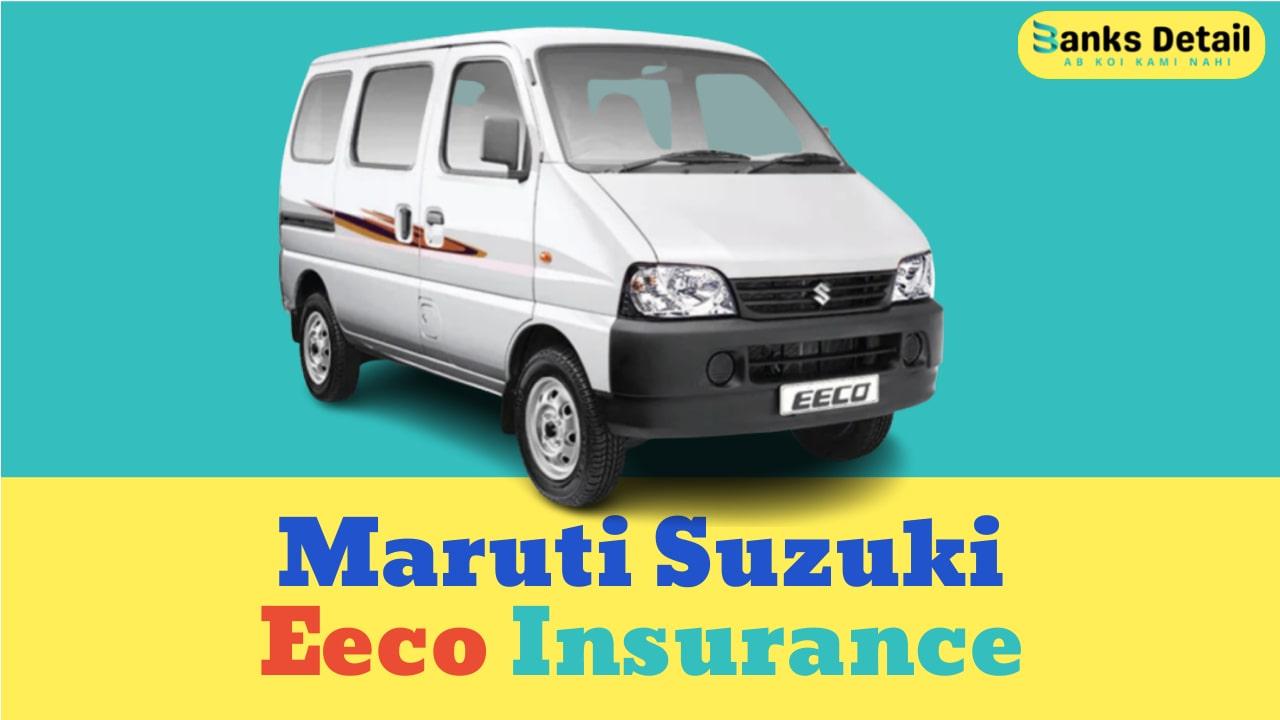

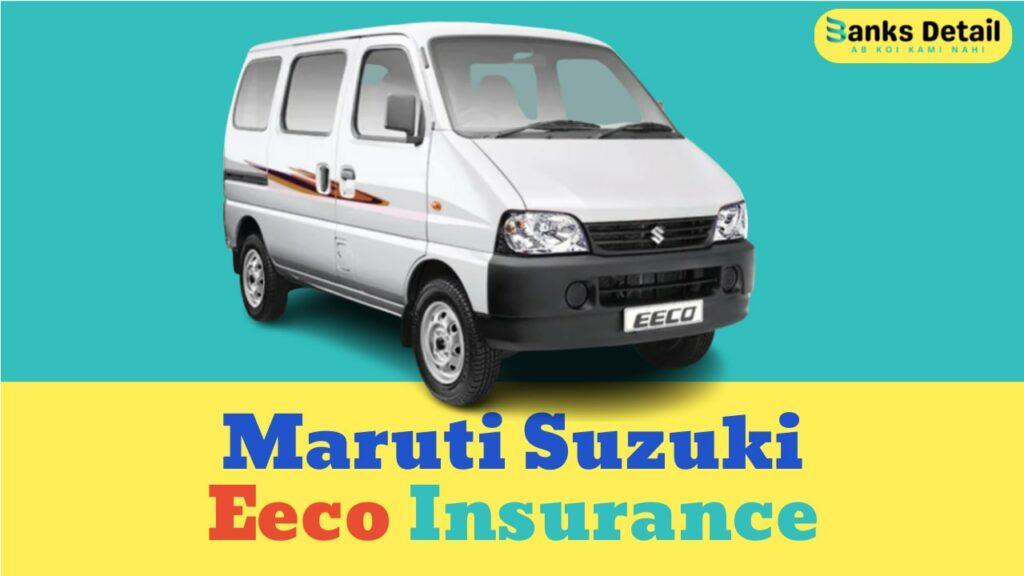

Maruti Suzuki Eeco Insurance: Compare Quotes & Save Up to 50%

Do you own a Maruti Suzuki Eeco? If so, you need insurance!

Insurance is important for everyone who owns a vehicle, but it’s especially important for Maruti Suzuki Eeco owners. That’s because the Eeco is a popular van in India, and it’s often used for commercial purposes. This means that if you’re involved in an accident, you could be held liable for a lot of damage.

Insurance can protect you financially in the event of an accident. It can also provide you with other benefits, such as roadside assistance and personal accident cover. So if you own a Maruti Suzuki Eeco, make sure you get insurance today!

Here are some other ways to make your introduction more engaging:

- Use a strong hook to grab the reader’s attention. For example, you could start with a statistic or a story about someone who was injured in an accident and didn’t have insurance.

- Personalize your introduction by addressing the reader directly. For example, you could say something like, “If you’re a Maruti Suzuki Eeco owner, this article is for you.”

- Use vivid language to paint a picture in the reader’s mind. For example, you could describe the feeling of being involved in an accident or the peace of mind that comes with having insurance.

Types of Maruti Suzuki Eeco Insurance

The two main types of Maruti Suzuki Eeco insurance are as follows:

Third-party insurance is the minimum legal requirement for driving a car in India. It covers damage to the property of third parties, such as other vehicles and property, in the event of an accident. Third-party insurance does not cover damage to your own vehicle.

Comprehensive insurance covers damage to your own vehicle, as well as damage to the property of third parties. Comprehensive insurance also covers other costs, such as medical expenses and legal fees.

Here is a table that summarizes the key differences between third-party insurance and comprehensive insurance:

| Feature | Third-party insurance | Comprehensive insurance |

|---|---|---|

| What is covered | Damage to the property of third parties in the event of an accident | Damage to your own vehicle, as well as damage to the property of third parties |

| Is it mandatory? | Yes | No |

| What are the costs? | Lower | Higher |

When choosing between third-party insurance and comprehensive insurance, you should consider the following factors:

- The value of your vehicle

- Your driving habits

- Your budget

If you have a relatively new and expensive vehicle, comprehensive insurance may be a good option for you. If you have an older or less expensive vehicle, third-party insurance may be sufficient. If you are on a tight budget, third-party insurance may be the only option available to you.

No matter which type of insurance you choose, it is important to read the policy carefully and understand the terms and conditions. This will help you to ensure that you are properly covered in the event of an accident.

Benefits of Maruti Suzuki Eeco Insurance

Here are some of the benefits of Maruti Suzuki Eeco insurance:

Financial protection in the event of an accident: Insurance can help to pay for the costs of an accident, such as repairs to your vehicle, medical expenses, and legal fees. This can help to protect you from financial ruin in the event of a major accident.

Roadside assistance: Roadside assistance can help you if your vehicle breaks down or gets into an accident. This can include services such as towing, jump-starting your battery, and providing you with gas.

Personal accident cover: Personal accident cover can help to pay for medical expenses and other costs if you are injured in an accident. This can include costs such as hospitalization, surgery, and rehabilitation.

Legal expenses cover: Legal expenses cover can help to pay for the costs of hiring a lawyer if you are involved in a legal dispute related to an accident. This can include costs such as court fees, legal fees, and expert witness fees.

Waiver of depreciation: Waiver of depreciation can help to protect you from financial loss if your vehicle is totaled in an accident. This means that your insurance company will pay the full market value of your vehicle, even if it has depreciated in value.

Zero deductible: Zero deductible means that you will not have to pay any out-of-pocket costs when you make a claim on your insurance policy. This can save you money in the event of an accident.

Engine protection: Engine protection can help to pay for the costs of repairing or replacing your engine if it is damaged in an accident. This can be a significant expense, so engine protection can be a valuable benefit

Customized add-on covers: In addition to the standard benefits of insurance, you may also be able to add on customized add-on covers that fit your specific needs. These can include covers for things like theft, floods, and natural disasters.

Increased affordability due to the availability of discounts and offers: There are a number of discounts and offers available that can help to make insurance more affordable. These discounts can be based on factors such as your driving record, your age, and the type of vehicle you own.

Peace of mind knowing that you are protected financially in the event of an accident: The peace of mind that comes with knowing that you are protected financially in the event of an accident is priceless. Insurance can help to give you peace of mind and the confidence to drive safely.

Factors Affecting Maruti Suzuki Eeco Insurance Premiums

- The age of the vehicle: Older vehicles are generally more expensive to insure than newer vehicles. This is because older vehicles are more likely to break down and require repairs.

- The driver’s age and experience: Younger drivers and drivers with less experience are generally more expensive to insure than older drivers and drivers with more experience. This is because younger drivers are more likely to be involved in accidents.

- The type of coverage: The type of coverage you choose will also affect your premiums. Comprehensive insurance is generally more expensive than third-party insurance.

- The make and model of the vehicle: The make and model of your vehicle can also affect your premiums. Some vehicles are more expensive to insure than others, depending on their safety ratings and the frequency of thefts.

- The area where the vehicle is being driven: The area where you live can also affect your premiums. Areas with higher crime rates and more traffic accidents tend to have higher insurance premiums.

- The driver’s claims history: If you have a history of making claims on your insurance policy, your premiums will likely be higher. This is because insurers view drivers with a history of claims as being more likely to make future claims.

- The insurer: The insurer you choose can also affect your premiums. Some insurers charge higher premiums than others. It is important to compare quotes from a variety of insurers before choosing one.

You can take steps to lower your insurance premiums, such as:

- Increasing your deductible: Raising your deductible will lower your premiums. However, it is important to make sure that you can afford to pay the deductible in the event of an accident.

- Improving your driving record: Keeping a clean driving record will help to lower your premiums. If you have any accidents or traffic violations on your record, try to get them dismissed or reduced.

- Adding safety features to your vehicle: Installing safety features, such as airbags and anti-lock brakes, can help to lower your premiums.

- Shopping around for quotes: It is important to compare quotes from a variety of insurers before choosing one. This will help you to ensure that you are getting the best possible price.

How to Get Maruti Suzuki Eeco Insurance

- Online comparison tools: There are a number of online comparison tools that can help you compare quotes from a variety of insurance companies. This is a quick and easy way to get an idea of the different options available to you.

- Your insurance agent: If you already have insurance with a particular company, you can contact your insurance agent to get a quote for Maruti Suzuki Eeco insurance. Your agent can also help you understand the different types of coverage available and choose the right policy for your needs.

- Direct insurers: There are also a number of direct insurers that offer Maruti Suzuki Eeco insurance. Direct insurers sell insurance directly to consumers, without the need for an insurance agent. This can be a good option if you want to compare quotes from a variety of insurers without having to deal with an insurance agent.

When you are comparing quotes, it is important to consider the following factors:

- The type of coverage: Make sure you understand the different types of coverage available and choose the right policy for your needs.

- The price: Compare quotes from a variety of insurers to get the best possible price.

- The terms and conditions: Make sure you read the terms and conditions carefully before you choose a policy. This will help you to understand what is covered and what is not covered by your insurance policy.

It is also important to make sure that you are comfortable with the insurance company you choose. You should do some research to make sure that the company has a good reputation and that they are financially stable.

Once you have chosen an insurance company, you will need to fill out an application and provide some information about yourself and your vehicle. The insurance company will then review your application and issue you a policy.

It is important to keep your insurance policy up to date. If you make any changes to your vehicle or your personal information, you will need to update your policy accordingly. You should also review your policy regularly to make sure that it still meets your needs.

When to Get Maruti Suzuki Eeco Insurance

Yes, it is important to get Maruti Suzuki Eeco insurance as soon as you buy the vehicle. This will ensure that you are covered in the event of an accident. Third-party insurance is mandatory in India, and it is important to have comprehensive insurance as well.

Here are some of the reasons why you should get Maruti Suzuki Eeco insurance as soon as you buy the vehicle:

- To protect yourself financially: If you are involved in an accident, insurance can help to pay for the costs of repairs to your vehicle, medical expenses, and legal fees. This can help to protect you from financial ruin in the event of a major accident.

- To comply with the law: Third-party insurance is mandatory in India. If you are caught driving without insurance, you could be fined or have your vehicle impounded.

- To give yourself peace of mind: Knowing that you are covered in the event of an accident can give you peace of mind and allow you to drive more safely.

There are a few different types of insurance that you can get for your Maruti Suzuki Eeco:

- Third-party insurance: This type of insurance covers damage to the property of third parties in the event of an accident. It does not cover damage to your own vehicle.

- Comprehensive insurance: This type of insurance covers damage to your own vehicle, as well as damage to the property of third parties. It also covers other costs, such as medical expenses and legal fees.

- Add-on covers: There are a number of add-on covers that you can get for your Maruti Suzuki Eeco insurance. These covers can provide additional protection for things like theft, floods, and natural disasters.

It is important to compare quotes from a variety of insurance companies before you choose one. This will help you to ensure that you are getting the best possible price for the coverage you need.

You should also review your policy regularly to make sure that it still meets your needs. If you make any changes to your vehicle or your personal information, you will need to update your policy accordingly.

How to Renew Maruti Suzuki Eeco Insurance

Here are the steps on how to renew your Maruti Suzuki Eeco insurance:

- Check your policy expiration date: The first step is to check your policy expiration date. This information is usually found on the declarations page of your policy.

- Contact your insurance company: Once you know your policy expiration date, you can contact your insurance company to renew your policy. You can do this online, by phone, or in person at your insurance agent’s office.

- Provide your policy information: When you contact your insurance company, you will need to provide them with your policy number and other relevant information. This information will help them to identify your policy and process your renewal request.

- Review your coverage: Once your insurance company has processed your renewal request, they will send you a new policy document. You should review this document carefully to make sure that your coverage is still accurate.

- Pay your premium: Once you have reviewed your coverage, you will need to pay your premium. You can usually pay your premium online, by phone, or by mail.

- Get your new policy: Once you have paid your premium, your insurance company will issue you a new policy document. This document will be valid for the next policy period.

Here are some tips for renewing your Maruti Suzuki Eeco insurance:

- Renew your policy early: It is important to renew your policy early, so that you do not have a lapse in coverage. A lapse in coverage can make it more difficult to get insurance in the future.

- Compare quotes: It is a good idea to compare quotes from a variety of insurance companies before you renew your policy. This will help you to ensure that you are getting the best possible price.

- Ask about discounts: Many insurance companies offer discounts for things like good driving records, safety features, and multi-policy discounts. Ask your insurance company about any discounts that you may be eligible for.

- Review your coverage: It is a good idea to review your coverage every year to make sure that it still meets your needs. If you have any changes to your vehicle or your personal information, you will need to update your policy accordingly.

Filing a Claim

- Gather your information: The first step is to gather all of the information you will need to file a claim. This includes the date, time, and location of the accident, as well as the names and contact information of the other drivers involved. You should also take pictures of the damage to your vehicle and the scene of the accident.

- Contact your insurance company: Once you have gathered all of the necessary information, you should contact your insurance company to file a claim. You can usually do this online, by phone, or in person at your insurance agent’s office.

- Provide your information: When you contact your insurance company, you will need to provide them with your policy number and other relevant information. This information will help them to identify your policy and process your claim.

- Provide details of the accident: You will also need to provide details of the accident, including the date, time, and location of the accident, as well as the names and contact information of the other drivers involved. You should also provide them with pictures of the damage to your vehicle and the scene of the accident.

- Provide proof of your losses: You will need to provide proof of your losses, such as estimates from repair shops or medical bills.

- Follow up with your insurance company: It is important to follow up with your insurance company regularly to make sure that your claim is being processed. You should also keep a record of all of your communications with your insurance company.

Here are some tips for filing a claim with your insurance company:

- Be prepared: Gather all of the necessary information before you contact your insurance company. This will help to speed up the claims process.

- Be clear and concise: When you are providing information to your insurance company, be clear and concise. This will help to avoid any confusion.

- Be cooperative: Cooperate with your insurance company during the claims process. This will help to ensure that your claim is processed as quickly as possible.

- Ask questions: If you have any questions about the claims process, don’t hesitate to ask your insurance company. They should be able to answer any questions you have.

Filing a claim can be a stressful experience, but it is important to remember that your insurance company is there to help you. By following these tips, you can make the claims process as smooth as possible.

Rights of Insurance Policyholders

As an insurance policyholder, you have certain rights. These rights are protected by the law and you should be aware of them. Here are some of your rights as an insurance policyholder:

- The right to be treated fairly: You have the right to be treated fairly by your insurer. This means that they should not discriminate against you based on your race, religion, gender, or any other protected class. They should also not deny you coverage or treat you differently because you have filed a claim in the past.

- The right to be informed: You have the right to be informed about the terms and conditions of your insurance policy. This includes the coverage that you are entitled to, the deductibles and copays that you are responsible for, and the process for filing a claim.

- The right to file a complaint: If you believe that your insurer has violated your rights, you have the right to file a complaint. You can file a complaint with your insurer directly or with the state insurance regulator.

- The right to take legal action: If your insurer has violated your rights and you have not been able to resolve the issue through other means, you have the right to take legal action. You can sue your insurer in court for damages.

It is important to be aware of your rights as an insurance policyholder. If you believe that your rights have been violated, you should take action to protect yourself.

Frequently Asked Questions (FAQs) About Maruti Suzuki Eeco Insurance

What is Maruti Suzuki Eeco insurance?

Maruti Suzuki Eeco insurance is a type of motor insurance that covers damage to your Maruti Suzuki Eeco vehicle, as well as damage to the property of others in the event of an accident.

What are the different types of Maruti Suzuki Eeco insurance?

There are two main types of Maruti Suzuki Eeco insurance: third-party insurance and comprehensive insurance.

Third-party insurance covers damage to the property of others in the event of an accident. It does not cover damage to your own vehicle.

Comprehensive insurance covers damage to your own vehicle, as well as damage to the property of others. It also covers other costs, such as medical expenses and legal fees.

What are the factors that affect Maruti Suzuki Eeco insurance premiums?

The factors that affect Maruti Suzuki Eeco insurance premiums include:

The age of the vehicle: Older vehicles are generally more expensive to insure than newer vehicles.

The driver’s age and experience: Younger drivers and drivers with less experience are generally more expensive to insure than older drivers and drivers with more experience.

The type of coverage: Comprehensive insurance is generally more expensive than third-party insurance.

The make and model of the vehicle: Some vehicles are more expensive to insure than others, depending on their safety ratings and the frequency of thefts.

The area where the vehicle is being driven: Areas with higher crime rates and more traffic accidents tend to have higher insurance premiums.

The driver’s claims history: If you have a history of making claims on your insurance policy, your premiums will likely be higher. This is because insurers view drivers with a history of claims as being more likely to make future claims.

The insurer: The insurer you choose can also affect your premiums. Some insurers charge higher premiums than others. It is important to compare quotes from a variety of insurers before you choose one.

How do I get Maruti Suzuki Eeco insurance?

You can get Maruti Suzuki Eeco insurance from a variety of insurance companies. You can compare quotes from a variety of insurance companies using an online comparison tool or by contacting your insurance agent.

How much does Maruti Suzuki Eeco insurance cost?

The cost of Maruti Suzuki Eeco insurance varies depending on the factors mentioned above. You can get a quote from an insurance company to find out how much insurance will cost you.

What is the process for filing a claim for Maruti Suzuki Eeco insurance?

The process for filing a claim for Maruti Suzuki Eeco insurance varies depending on the insurance company.

You will generally need to gather some information about the accident, such as the date, time, and location of the accident, as well as the names and contact information of the other drivers involved.

You will also need to provide proof of your losses, such as estimates from repair shops or medical bills.

What are my rights as a Maruti Suzuki Eeco insurance policyholder?

As a Maruti Suzuki Eeco insurance policyholder, you have certain rights.

These rights include the right to be treated fairly by the insurer, the right to be informed about the terms and conditions of your policy, the right to file a complaint with the insurer, and the right to take legal action against the insurer if your rights are violated.

Conclusion

Maruti Suzuki Eeco insurance is an important investment for anyone who owns this vehicle. It can protect you financially in the event of an accident, and it can also provide you with other valuable benefits, such as:

- Peace of mind: Knowing that you are covered in the event of an accident can give you peace of mind and allow you to drive more safely.

- Financial protection: If you are involved in an accident, insurance can help to pay for the costs of repairs to your vehicle, medical expenses, and legal fees. This can help to protect you from financial ruin.

- Discounts: Many insurance companies offer discounts for things like good driving records, safety features, and multi-policy discounts. This can help you to save money on your insurance premiums.

If you own a Maruti Suzuki Eeco, I urge you to get insurance today. It is an important investment that can protect you financially and give you peace of mind.

Read More About:- Insurance, Car Insurance, Maruti Suzuki, Maruti Suzuki Eeco