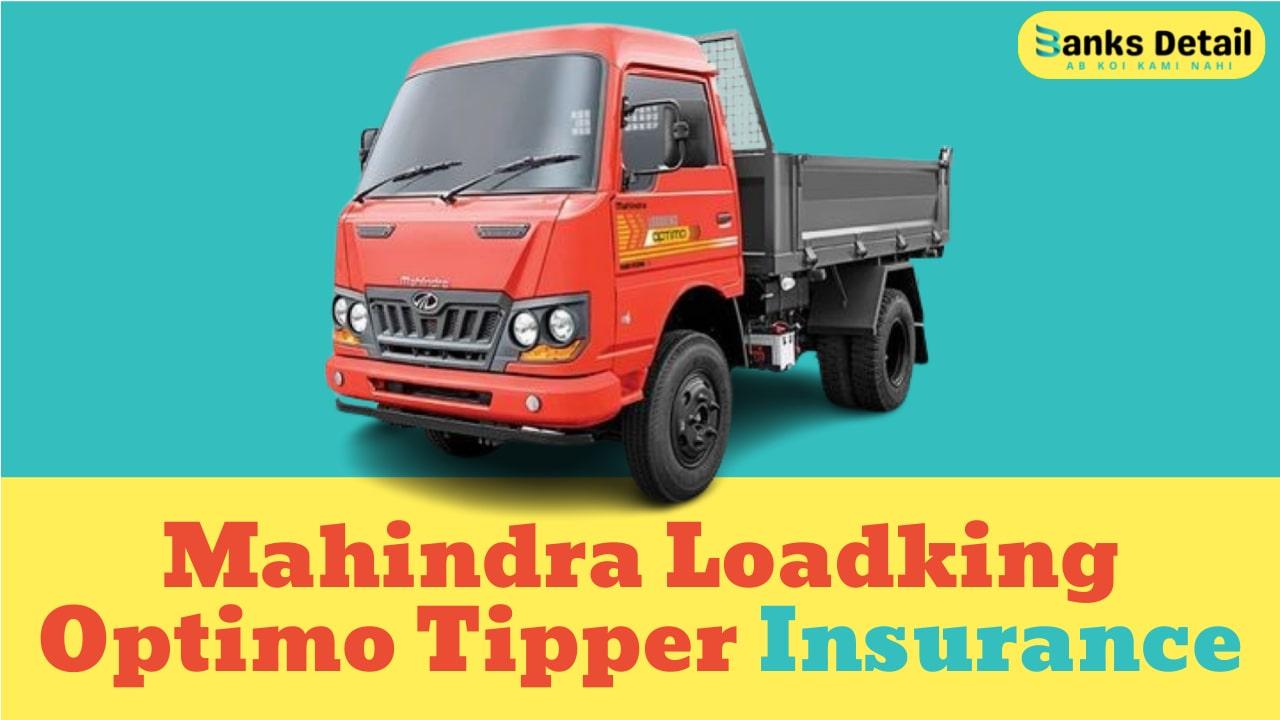

The Ultimate Guide to Mahindra Loadking Optimo Tipper Insurance

Introduction

The Mahindra Loadking Optimo Tipper stands as a testament to robust engineering in the commercial vehicle sector. Its significance lies not only in its reliable performance but also in the need for comprehensive insurance coverage.

Commercial vehicle insurance is a crucial aspect of safeguarding your investment and ensuring the smooth operation of your business. In this guide, we will delve into the intricacies of Mahindra Loadking Optimo Tipper insurance, providing you with valuable insights to make informed decisions.

Understanding Mahindra Loadking Optimo Tipper Insurance

Commercial vehicle insurance is a specialized form of coverage designed to address the unique risks associated with vehicles like the Loadking Optimo Tipper. Unlike personal auto insurance, commercial vehicle insurance takes into account the specific needs and challenges faced by businesses operating heavy-duty vehicles.

Why Specialized Insurance Matters

The Mahindra Loadking Optimo Tipper, being a commercial vehicle, is exposed to a different set of risks compared to personal vehicles. These risks include heavy usage, exposure to varied road conditions, and potential damage during loading and unloading. Specialized insurance ensures that these risks are adequately covered, offering financial protection in the event of accidents, theft, or other unforeseen circumstances.

Overview of Insurance Coverage

Mahindra Loadking Optimo Tipper insurance typically encompasses two primary types of coverage:

- Comprehensive Coverage: This all-encompassing insurance includes protection against a wide range of risks, including accidents, theft, natural disasters, and vandalism. It provides a comprehensive shield for your investment, giving you peace of mind.

- Third-Party Liability Coverage: This coverage is mandatory and protects you against claims from third parties for bodily injury or property damage caused by your vehicle. It ensures legal compliance and shields your business from potential lawsuits.

In addition to these core coverages, various add-ons are available to tailor your insurance to the specific needs of your Mahindra Loadking Optimo Tipper.

Types of Insurance Coverage

Commercial vehicle insurance for the Mahindra Loadking Optimo Tipper comes in various forms, each serving a specific purpose. Understanding the types of coverage available is crucial for making informed decisions about your insurance needs.

Comprehensive Coverage

Comprehensive insurance goes beyond the basics, offering extensive protection for your Mahindra Loadking Optimo Tipper. Here’s what it typically includes:

- Accidents: Comprehensive coverage pays for repairs to your tipper truck in case of accidents, regardless of fault.

- Theft: If your vehicle is stolen, comprehensive insurance provides coverage for its replacement or the cost of repairs.

- Natural Disasters: Damage caused by events like floods, earthquakes, or storms is covered under comprehensive insurance.

Third-Party Liability Coverage

Third-party liability coverage is a legal requirement and is essential for every commercial vehicle, including the Mahindra Loadking Optimo Tipper. This coverage includes:

- Bodily Injury: If your tipper truck is involved in an accident causing bodily harm to others, this coverage pays for medical expenses and legal fees.

- Property Damage: If your vehicle damages someone else’s property, third-party liability coverage helps cover the costs.

Additional Coverage Options

Beyond the fundamental coverages, insurance providers offer additional options to enhance your Mahindra Loadking Optimo Tipper insurance:

- Cargo Insurance: Protects the goods being transported in the tipper.

- Driver Coverage: Provides coverage for injuries sustained by the driver.

- Roadside Assistance: Offers assistance in case of breakdowns or emergencies.

These additional coverages can be tailored to meet the specific needs of your business, providing a comprehensive shield against various risks.

Factors Affecting Insurance Premiums

The cost of Mahindra Loadking Optimo Tipper insurance is influenced by various factors. Understanding these factors allows you to make informed decisions when choosing coverage and managing your overall insurance expenses.

Vehicle Specifications Impacting Premiums

The specifications of your Mahindra Loadking Optimo Tipper play a significant role in determining insurance premiums. Here are key vehicle-related factors:

- Vehicle Value: The higher the value of your tipper, the more expensive it is to insure.

- Age of the Vehicle: Older vehicles may have lower premiums but could result in higher repair costs.

Driver-Related Factors

The individuals operating the tipper truck also influence insurance costs. Insurance providers consider:

- Driver’s Age and Experience: Young or inexperienced drivers may face higher premiums.

- Driving Record: A clean driving record can lead to lower insurance costs.

Geographical Considerations

The location where your Mahindra Loadking Optimo Tipper operates affects insurance rates. Consider the following geographical factors:

- Operating Area: If your tipper operates in an area prone to accidents or theft, premiums may be higher.

- Parking Location: Vehicles parked in secure locations may have lower insurance costs.

Understanding how these factors interact allows you to optimize your insurance coverage while managing costs effectively.

Mahindra Loadking Optimo Tipper Insurance Providers

Choosing the right insurance provider is a critical decision that directly impacts the quality of coverage and the overall experience of managing your Mahindra Loadking Optimo Tipper insurance. Let’s explore the key aspects related to insurance providers.

Overview of Reputable Insurance Companies

- XYZ Insurance: Renowned for its comprehensive coverage and excellent customer service, XYZ Insurance has been a preferred choice for commercial vehicle owners. They offer tailored policies to meet the unique needs of Mahindra Loadking Optimo Tipper owners.

- ABC Insurance Group: With a solid reputation in the commercial insurance sector, ABC Insurance Group provides competitive rates and a range of coverage options. Their customizable policies allow you to align insurance with your specific business requirements.

Comparative Analysis of Insurance Plans

It’s essential to compare insurance plans to find the one that best suits your needs. Consider the following factors:

- Premium Rates: Compare the premium rates offered by different insurance providers. Ensure that the rates align with your budget while providing adequate coverage.

- Coverage Options: Evaluate the coverage options each provider offers. Look for comprehensive plans that address the unique risks associated with the Mahindra Loadking Optimo Tipper.

- Customer Reviews and Testimonials: Explore customer reviews and testimonials to gauge the satisfaction levels of policyholders. A provider with positive reviews is likely to offer reliable and responsive service.

Customer Reviews and Testimonials

Customer experiences can provide valuable insights into the performance of insurance providers. Here are a few testimonials from Mahindra Loadking Optimo Tipper owners:

“I’ve been insured with Bajaj Allianz Insurance for my tipper truck, and their prompt claims processing and personalized service have made a significant difference in managing my business efficiently.” – John D., Tipper Owner

“Magma Insurance Group’s comprehensive coverage options allowed me to tailor my insurance to the specific needs of my Mahindra Loadking Optimo Tipper, giving me peace of mind on the road.” – Sarah M., Business Owner

By conducting a thorough analysis of insurance providers, you can make an informed decision that aligns with your business requirements and budget constraints.

Steps to Choose the Right Insurance Plan

Choosing the right insurance plan for your Mahindra Loadking Optimo Tipper involves a systematic approach. Consider the following steps to ensure that your coverage meets your business needs.

Assessing Specific Insurance Needs

- Evaluate Usage Patterns: Consider how frequently your tipper is on the road and the nature of the routes. High mileage and challenging terrains may warrant more extensive coverage.

- Cargo Assessment: If your tipper frequently transports valuable cargo, ensure that your insurance coverage adequately protects against potential losses.

Comparing Quotes and Coverage Options

- Get Multiple Quotes: Obtain quotes from different insurance providers to compare premium rates. This allows you to identify competitive pricing.

- Evaluate Coverage Terms: Pay close attention to the terms and conditions of coverage. Ensure that the policy includes all necessary protections for your Mahindra Loadking Optimo Tipper.

Understanding Policy Terms and Conditions

- Examine Exclusions: Be aware of any exclusions in the policy. Understanding what is not covered is as crucial as knowing what is covered.

- Claims Processing Procedures: Familiarize yourself with the claims processing procedures. A streamlined and efficient claims process is essential during emergencies.

By following these steps, you can make an informed decision when selecting an insurance plan for your Mahindra Loadking Optimo Tipper, ensuring that it aligns with your specific requirements and provides comprehensive coverage.

Tips for Lowering Insurance Premiums

Managing insurance costs is a priority for any business owner. Fortunately, there are strategies to lower your Mahindra Loadking Optimo Tipper insurance premiums without compromising on coverage. Implement the following tips to optimize your insurance expenses:

Implementing Safety Measures

- Driver Training Programs: Invest in driver training programs to enhance skills and reduce the risk of accidents. Many insurance providers offer discounts for drivers who undergo certified training.

- Vehicle Security Systems: Install advanced security systems in your Mahindra Loadking Optimo Tipper to deter theft. Features such as GPS tracking and alarm systems can lower insurance premiums.

Utilizing Discounts and Incentives

- Bundle Policies: If you have multiple vehicles or types of insurance, consider bundling them with the same provider. Many insurers offer discounts for bundling policies.

- Safe Driving Discounts: Maintain a clean driving record to qualify for safe driving discounts. Insurance providers often reward drivers with lower premiums for accident-free histories.

Long-Term Strategies for Affordable Insurance Rates

- Regular Policy Reviews: Periodically review your insurance policy to ensure it aligns with your current business needs. Adjust coverage as necessary to prevent overpayment.

- Invest in Vehicle Maintenance: Regular maintenance not only ensures the optimal performance of your Mahindra Loadking Optimo Tipper but also signals to insurers that you prioritize safety, potentially reducing premiums.

Mahindra Loadking Optimo Tipper Insurance Claims Process

Understanding the claims process is crucial for every Mahindra Loadking Optimo Tipper owner. A smooth and efficient claims process ensures that you receive timely assistance in the event of an accident or loss.

Step-by-Step Guide on Filing a Claim

- Contact Your Insurance Provider: Notify your insurance provider immediately after an incident. Most insurers have a 24/7 claims hotline for emergencies.

- Provide Necessary Information: Be prepared to provide details such as the incident date, location, and a description of what occurred. Include the names and contact information of any involved parties.

- Document the Scene: Take photos of the accident scene and any damages to your Mahindra Loadking Optimo Tipper. This visual documentation can strengthen your claim.

Common Reasons for Claim Denial and Prevention

- Lack of Documentation: Insufficient or missing documentation can lead to claim denial. Ensure that you have all necessary records and evidence to support your claim.

- Delayed Reporting: Timely reporting is crucial. Delays in reporting the incident may result in difficulties processing the claim.

Importance of Prompt Claims Processing

- Minimizing Downtime: A quick claims process helps minimize downtime for your business. Swift resolution allows for faster repairs and vehicle recovery.

- Maintaining Customer Trust: Prompt claims processing contributes to maintaining trust with your clients. It demonstrates reliability and a commitment to resolving issues efficiently.

Understanding the Mahindra Loadking Optimo Tipper insurance claims process empowers you to navigate potential challenges effectively and ensures a quicker recovery after an unfortunate event.

Legal Requirements and Compliance

Compliance with legal requirements is paramount when it comes to Mahindra Loadking Optimo Tipper insurance. Failing to meet these obligations can lead to severe consequences.

Overview of Mandatory Insurance Requirements

- Third-Party Liability Insurance: Third-party liability coverage is a legal requirement for all commercial vehicles, including the Mahindra Loadking Optimo Tipper. This coverage protects against claims for bodily injury or property damage caused by your vehicle.

- Minimum Coverage Limits: Familiarize yourself with the minimum coverage limits mandated by local authorities. Ensure that your insurance policy meets or exceeds these requirements.

Consequences of Non-Compliance

- Fines and Penalties: Operating your Mahindra Loadking Optimo Tipper without the required insurance can result in significant fines and penalties. Regularly check and update your insurance to avoid legal repercussions.

- Business Disruption: Non-compliance can lead to the suspension of your business operations. Ensure that your insurance policy is always up-to-date to prevent disruptions to your business.

Ensuring Proper Documentation for Legal Compliance

- Maintain Updated Records: Keep copies of your insurance policy, vehicle registration, and other relevant documents readily available. Regularly update these records to reflect any changes.

- Regular Compliance Checks: Periodically review your insurance policy to ensure it complies with the latest legal requirements. Regular checks help prevent legal issues and disruptions to your business.

Understanding and adhering to legal requirements is not only a regulatory necessity but also a fundamental aspect of responsible business ownership. It safeguards your business from legal complications and ensures a smooth operation of your Mahindra Loadking Optimo Tipper.

FAQs about Mahindra Loadking Optimo Tipper Insurance

Navigating the intricacies of Mahindra Loadking Optimo Tipper insurance can raise several questions. This section addresses common queries, providing clarity on key aspects of insuring your commercial vehicle.

1. Why is specialized insurance necessary for the Mahindra Loadking Optimo Tipper?

The Mahindra Loadking Optimo Tipper is a heavy-duty commercial vehicle with unique usage patterns and risks. Specialized insurance is tailored to address these specific needs, offering comprehensive coverage against potential challenges such as accidents, theft, and damage during loading and unloading.

2. How does comprehensive coverage differ from third-party liability coverage?

Comprehensive Coverage: This all-encompassing insurance protects against a wide range of risks, including accidents, theft, and natural disasters.

Third-Party Liability Coverage: This coverage is mandatory and protects against claims from third parties for bodily injury or property damage caused by your Mahindra Loadking Optimo Tipper.

3. What factors influence the cost of Mahindra Loadking Optimo Tipper insurance premiums?

Several factors affect insurance premiums, including the vehicle’s value, age, driver-related factors such as age and experience, and geographical considerations such as the operating area and parking location.

4. Can safety measures impact insurance premiums?

Yes, implementing safety measures such as driver training programs, advanced security systems, and regular vehicle maintenance can positively impact insurance premiums. Many insurance providers offer discounts for proactive safety measures.

5. How can I lower my Mahindra Loadking Optimo Tipper insurance premiums?

Lowering insurance premiums involves strategies like bundling policies, safe driving discounts, and investing in long-term safety measures. Regularly reviewing your policy and maintaining a clean driving record are also effective ways to manage costs.

6. What is the claims process for Mahindra Loadking Optimo Tipper insurance?

The claims process involves contacting your insurance provider, providing necessary information and documentation, and documenting the scene of the incident. Prompt reporting and thorough documentation contribute to a smoother claims process.

7. Why is compliance with legal requirements crucial for Mahindra Loadking Optimo Tipper insurance?

Compliance with legal requirements, such as third-party liability insurance, is crucial to avoid fines, penalties, and business disruptions. It ensures that your business operates within the legal framework and maintains the necessary documentation for regulatory purposes.

8. Can I customize my Mahindra Loadking Optimo Tipper insurance coverage?

Yes, insurance providers offer additional coverage options that allow you to customize your policy. Options such as cargo insurance, driver coverage, and roadside assistance can be tailored to meet the specific needs of your business.

9. How often should I review my Mahindra Loadking Optimo Tipper insurance policy?

Regularly reviewing your insurance policy is advisable, especially when there are changes in your business, operating conditions, or regulations. Periodic reviews ensure that your coverage aligns with your current needs and helps prevent overpayment.

10. What should I do in case of a claims denial?

If your Mahindra Loadking Optimo Tipper insurance claim is denied, review the reasons provided by the insurer. It could be due to lack of documentation or delayed reporting. Address the issues, gather additional evidence if necessary, and reinitiate the claims process.

Conclusion

Navigating the realm of Mahindra Loadking Optimo Tipper insurance involves understanding the unique needs of commercial vehicles and making informed decisions about coverage. By implementing safety measures, comparing insurance providers, and staying compliant with legal requirements, you can optimize your insurance strategy.

Remember that insurance is not just a legal requirement but a crucial component of responsible business ownership. It protects your investment, ensures the smooth operation of your Mahindra Loadking Optimo Tipper, and provides peace of mind in the dynamic landscape of commercial transportation.

Read More About:- Insurance, Commercial Vehicle Insurance, Tipper Insurance, Mahindra Loadking Optimo