Jamie Dimon Net Worth: Discover the Wealth of JPMorgan’s CEO

Introduction

Jamie Dimon, a prominent figure in the finance industry, has established himself as a respected leader and influential CEO.

Understanding Jamie Dimon’s net worth is of great importance to gain insights into his financial achievements and the impact he has on the banking world.

In this article, we will explore the fascinating journey of Jamie Dimon’s wealth and delve into various aspects of his net worth, including its calculation, comparisons, investments, and philanthropy.

Join us as we uncover the intricacies of Jamie Dimon’s financial success and its significance in the finance industry.

Jamie Dimon’s Background and Career

Jamie Dimon, born on March 13, 1956, in New York City, had an upbringing that would shape his future success in the finance industry. Growing up in a family with a strong financial background, Dimon developed an early interest in economics and business.

Dimon’s educational journey took him to esteemed institutions, starting with his undergraduate studies at Tufts University. He then pursued his MBA at Harvard Business School, where he further honed his business acumen and leadership skills.

Before assuming the role of CEO of JPMorgan Chase & Co., Jamie Dimon held several notable positions that paved the way for his ascent to the top. He gained valuable experience at prominent financial institutions, including American Express, where he served as the Chief Financial Officer.

Dimon’s strategic thinking and ability to navigate complex financial landscapes garnered attention within the industry.

Dimon’s career truly flourished when he took the helm of Bank One Corporation in 2000. Under his leadership, the struggling bank underwent a remarkable turnaround, with Dimon implementing transformative strategies to revitalize its operations.

This success drew the attention of JPMorgan Chase, leading to the merger of the two institutions in 2004.

As the CEO of JPMorgan Chase & Co., Jamie Dimon has made significant contributions to the growth and success of the company. His strong leadership, emphasis on innovation, and risk management expertise have propelled the organization to new heights.

Dimon’s unwavering commitment to fostering a strong corporate culture and delivering value to shareholders has earned him widespread acclaim.

Throughout his career, Dimon has garnered numerous accolades and recognition for his achievements. He has been named one of the most influential business leaders globally, with notable recognition from publications like Fortune and Forbes.

Dimon’s ability to navigate through challenging economic climates and his commitment to driving positive change within the finance industry has solidified his position as a respected figure in the business world.

Jamie Dimon’s Financial Success

Jamie Dimon’s financial success is undeniably impressive, with his accumulated wealth reflecting his remarkable achievements in the finance industry.

Through his strategic decision-making and leadership, Dimon has not only solidified his personal fortune but also played a pivotal role in driving the growth and profitability of JPMorgan Chase & Co.

Dimon’s net worth, which is estimated to be in the billions, is the result of various factors that have contributed to his financial success.

One key factor is his exceptional leadership skills and vision. Dimon’s ability to steer JPMorgan Chase & Co. through turbulent times and capitalize on market opportunities has been instrumental in enhancing the company’s performance and generating substantial returns for its stakeholders.

Another contributing factor to Dimon’s financial success is his expertise in risk management. Through effective risk assessment and mitigation strategies, Dimon has minimized the potential impact of adverse market conditions on JPMorgan Chase & Co., safeguarding its profitability and stability.

His emphasis on prudent risk management has earned the confidence of investors and positioned the company for long-term success.

Dimon’s relentless pursuit of innovation and technological advancements has also played a significant role in his financial achievements. By embracing emerging technologies and fostering a culture of innovation within JPMorgan Chase & Co., Dimon has positioned the company at the forefront of the rapidly evolving finance industry.

This forward-thinking approach has not only driven operational efficiencies but has also opened new avenues for revenue generation and sustainable growth.

Furthermore, Dimon’s ability to attract and retain top talent has been a key driver of JPMorgan Chase & Co.’s success. By assembling a skilled and diverse team of professionals, Dimon has created a dynamic and collaborative work environment that fosters creativity and excellence.

This, in turn, has translated into strong financial performance for the company and contributed to his own financial success. Overall, the impact of Jamie Dimon’s leadership on the growth and profitability of JPMorgan Chase & Co. cannot be overstated.

Through his strategic decision-making, emphasis on risk management, focus on innovation, and ability to assemble high-performing teams, Dimon has not only enhanced the company’s financial standing but has also solidified his position as one of the most influential figures in the finance industry.

Evaluating Jamie Dimon’s Net Worth

Estimating the net worth of Jamie Dimon involves employing various methodologies and considering a range of factors to arrive at a comprehensive assessment. While the exact figures may vary, financial analysts and experts utilize the following approaches to calculate his wealth:

- Publicly Disclosed Information: Publicly available information, such as regulatory filings, annual reports, and disclosures made by JPMorgan Chase & Co., provides valuable insights into Jamie Dimon’s compensation packages, including salary, bonuses, stock options, and other forms of remuneration.

- Stock Holdings: Analysis of Dimon’s stock holdings is an essential aspect of estimating his net worth. By examining his ownership stakes in JPMorgan Chase & Co. and other publicly traded companies, along with the current market value of these shares, a valuation can be derived.

- Investment Portfolios: Jamie Dimon’s investment portfolios, which encompass a diverse range of assets, contribute significantly to his net worth. By evaluating his investments in stocks, bonds, real estate, private equity, and other financial instruments, analysts can estimate the value of these holdings and their impact on his overall wealth.

- Compensation and Benefits: In addition to salary and bonuses, other elements of Dimon’s compensation, such as retirement benefits, deferred compensation plans, and perquisites, are considered when assessing his net worth.

- Business Ventures and Board Memberships: Jamie Dimon’s involvement in various business ventures and board memberships outside of JPMorgan Chase & Co. can contribute to his net worth. These include directorships or investments in other companies, which are taken into account during the valuation process.

To ensure accuracy and comprehensive evaluation, industry benchmarks and peer comparisons play a crucial role in assessing Jamie Dimon’s net worth. Comparing his wealth with other influential figures in the finance industry provides insights into his financial standing relative to his peers. Benchmarks such as Forbes’ billionaire rankings and industry-specific wealth indices serve as valuable points of reference for such comparisons.

While the methodologies used to estimate Jamie Dimon’s net worth are meticulous, it is important to note that net worth calculations are approximate and subject to change based on market fluctuations, new investment activities, and other financial developments.

Comparisons and Rankings

Comparing Jamie Dimon’s net worth with other notable figures in the finance industry provides valuable context and insight into his financial standing. While net worth rankings may vary depending on the source and time, they offer a glimpse into his relative wealth and position within the industry. Some key points to consider include:

- Forbes’ Billionaire Rankings: Forbes, a renowned publication, compiles an annual list of billionaires worldwide. Jamie Dimon’s net worth is often featured in this prestigious ranking, positioning him among the wealthiest individuals globally. The Forbes list showcases the vast wealth accumulated by Dimon and highlights his standing among the elite in terms of financial success.

- Comparison with Peers: Comparing Jamie Dimon’s net worth with other influential figures in the finance industry provides valuable insights into his relative financial standing. This analysis allows for a deeper understanding of Dimon’s position within the industry and offers a benchmark to gauge the magnitude of his wealth.

- Implications of Financial Standing: Jamie Dimon’s substantial net worth carries implications that extend beyond personal wealth. His financial standing among industry leaders solidifies his influence and reputation within the finance sector. Dimon’s significant wealth serves as a testament to his successful career and strategic decision-making, positioning him as a respected and influential figure.

It is important to note that net worth rankings and comparisons are subject to fluctuations due to market dynamics, investments, and other factors. However, considering Jamie Dimon’s net worth in relation to other notable finance industry figures and examining his placement in wealth lists provides valuable context to appreciate the magnitude of his financial achievements.

Investments and Assets

Jamie Dimon’s investment strategies and diverse portfolio have played a significant role in his financial success. Analyzing his investment approach and notable holdings provides insights into his wealth accumulation. Some key aspects to consider include:

- Investment Strategies: Jamie Dimon’s investment strategies are characterized by a combination of prudence, long-term vision, and calculated risk-taking. His approach involves a thorough analysis of market trends, industry dynamics, and economic indicators to identify investment opportunities with the potential for substantial returns.

- Stock Holdings: Dimon’s portfolio includes significant stock holdings in JPMorgan Chase & Co., the institution he leads as CEO. These holdings not only demonstrate his confidence in the company’s performance but also align his financial success with the success of the organization. Additionally, Dimon may have investments in other publicly traded companies within the finance industry and beyond.

- Real Estate Investments: Real estate investments are a notable aspect of Jamie Dimon’s diversified portfolio. Dimon’s holdings may include commercial properties, residential real estate, and other real estate assets. The inclusion of real estate investments in his portfolio adds stability and potential appreciation to his overall wealth.

- Other Asset Classes: Besides stocks and real estate, Dimon’s portfolio may include investments in various asset classes such as bonds, private equity, venture capital, and alternative investments. The allocation to different asset classes helps diversify his risk exposure and capitalize on different market opportunities.

- Impact of Market Trends: Jamie Dimon’s investment performance is subject to the influence of market trends and economic cycles. Analysis of these market trends, including interest rates, economic indicators, and regulatory developments, can provide insights into the potential impact on his investment returns and overall net worth.

Dimon’s investment strategies and diverse portfolio reflect his ability to navigate the complexities of the financial markets and capitalize on opportunities for wealth accumulation. While specific details of his investments may not be publicly disclosed, examining the general asset classes in his portfolio provides a broader understanding of his investment approach and the factors that contribute to his financial success.

Impact of Jamie Dimon’s Net Worth

Jamie Dimon’s substantial net worth extends beyond personal financial success. It carries significant implications for JPMorgan Chase & Co., its stakeholders, employees, and customers. Let’s explore these aspects in detail:

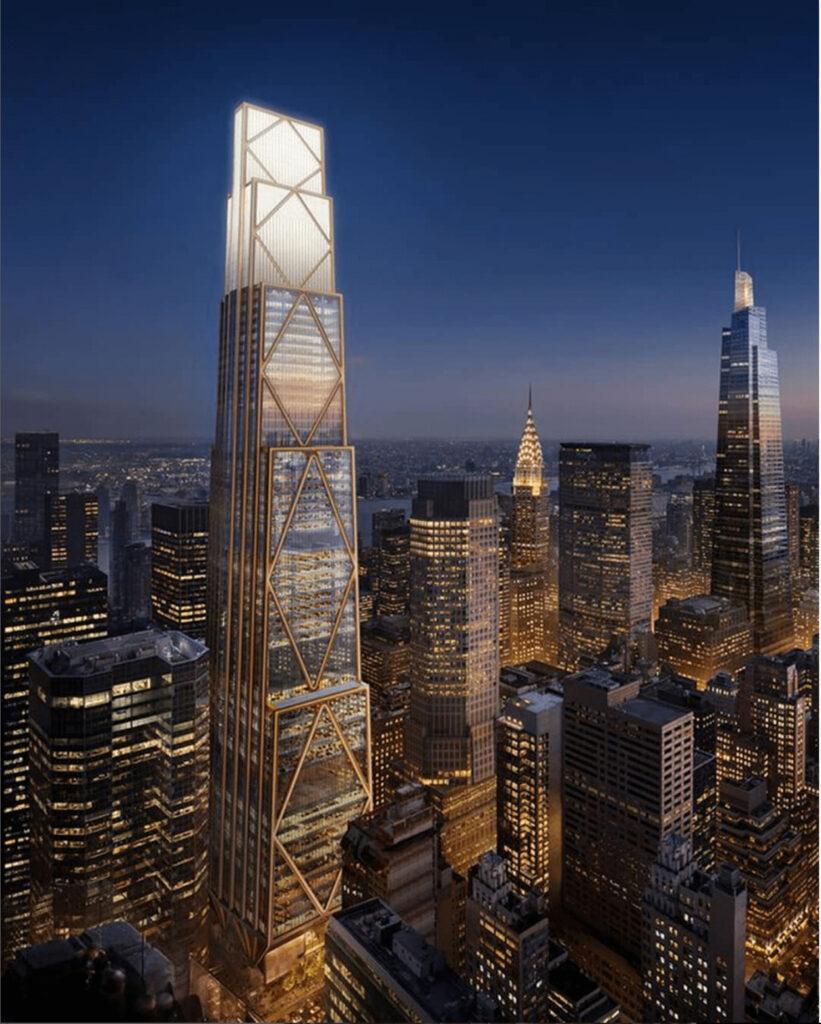

- Influence on JPMorgan Chase & Co.’s Reputation and Market Position: Jamie Dimon’s considerable wealth serves as a testament to his success and expertise in the finance industry. As the CEO of JPMorgan Chase & Co., his net worth reinforces the company’s reputation as a powerhouse in the banking world. Dimon’s financial achievements highlight the strength and stability of JPMorgan Chase & Co., fostering investor confidence and enhancing the organization’s market position.

- Role as a Leading Figure in the Banking Industry: Jamie Dimon’s leadership and influence extend beyond his position at JPMorgan Chase & Co. He is widely regarded as a leading figure in the banking industry. His extensive experience, strategic vision, and track record of success have earned him respect and recognition among his peers. Dimon’s role as a prominent industry figure elevates his voice and carries weight in shaping the direction of the finance sector.

- Impact on Investor Confidence: Jamie Dimon’s net worth and his leadership position have a direct impact on investor confidence in JPMorgan Chase & Co. His successful stewardship of the company and the correlation between his financial achievements and the organization’s performance provide reassurance to investors. Dimon’s wealth reinforces the perception of stability and growth potential, attracting investment and strengthening the company’s position in the eyes of shareholders.

- Effects on Stakeholders, Employees, and Customers: Jamie Dimon’s net worth carries implications for various stakeholders of JPMorgan Chase & Co. Employees may feel a sense of pride and confidence in working for a company led by a highly successful CEO. Customers may perceive JPMorgan Chase & Co. as a reliable institution under Dimon’s leadership, influencing their decision to entrust the bank with their financial needs. Additionally, Dimon’s philanthropic efforts, which are often associated with his wealth, can positively impact communities and social causes, further enhancing the bank’s reputation.

Dimon’s net worth, combined with his leadership role and industry influence, plays a significant role in shaping the perception and impact of JPMorgan Chase & Co. His financial success extends beyond personal wealth, influencing the organization’s reputation, investor confidence, and stakeholder perceptions. It underscores the symbiotic relationship between Dimon’s net worth and the continued success of JPMorgan Chase & Co.

Lesser-Known Facts about Jamie Dimon’s Net Worth

While Jamie Dimon’s financial success is widely recognized, there are lesser-known aspects that add depth to the understanding of his wealth accumulation. These include:

- Long-Term Investment Horizon: One of the lesser-known aspects of Jamie Dimon’s wealth accumulation is his long-term investment horizon. Dimon is known for his patient and disciplined approach to investments, focusing on strategies that have the potential for sustained growth over time. This long-term perspective allows him to weather short-term market fluctuations and capture value from long-term trends.

- Focus on Emerging Markets: Another lesser-known aspect of Dimon’s investment approach is his focus on emerging markets. He has shown a keen interest in economies with high growth potential and has made strategic investments in regions such as Asia and Latin America. This forward-thinking strategy allows Dimon to capitalize on emerging opportunities and diversify his portfolio.

- Philanthropic Initiatives: Jamie Dimon’s net worth has enabled him to engage in philanthropic initiatives that make a positive impact on society. While his philanthropic endeavors may not be as well-known as his financial achievements, Dimon has been involved in various charitable causes, including education, healthcare, and community development. These initiatives reflect his commitment to giving back and using his wealth for the greater good.

- Commitment to Diversity and Inclusion: Dimon has emphasized the importance of diversity and inclusion within JPMorgan Chase & Co. and the finance industry as a whole. While not directly related to his net worth, this commitment reflects his belief in creating an inclusive work environment that fosters innovation and drives better business outcomes.

- Sustainable Investing: In recent years, Jamie Dimon has shown an interest in sustainable investing. He recognizes the growing importance of environmental, social, and governance (ESG) factors in investment decisions. This commitment to sustainable investing aligns his financial success with his values and contributes to the broader sustainability agenda.

These lesser-known aspects of Jamie Dimon’s wealth accumulation highlight his strategic and multifaceted approach to financial success. By focusing on long-term growth, investing in emerging markets, engaging in philanthropy, promoting diversity and inclusion, and embracing sustainable investing, Dimon demonstrates a broader vision beyond pure financial gain. These aspects add depth to the understanding of his financial success and showcase his commitment to making a positive impact.

Philanthropy and Giving Back

Jamie Dimon’s philanthropic efforts reflect his commitment to giving back to society and making a positive impact. His charitable contributions encompass a wide range of causes and organizations. Let’s explore an overview of his philanthropic endeavors:

- Education: Jamie Dimon has shown a strong dedication to education. He has made significant contributions to educational institutions and initiatives aimed at improving access to quality education. His support has included scholarships, funding for educational programs, and partnerships with educational organizations.

- Community Development: Dimon has actively engaged in initiatives focused on community development. He has directed philanthropic resources toward projects that promote economic growth, affordable housing, and job creation in underserved communities. His contributions have helped revitalize neighborhoods and enhance the quality of life for residents.

- Healthcare: Dimon has demonstrated a commitment to healthcare causes. He has supported medical research, advancements in healthcare technology, and initiatives that aim to improve access to healthcare services, particularly for vulnerable populations. His contributions have had a tangible impact on medical institutions and healthcare organizations.

- Disaster Relief: During times of crisis, Jamie Dimon has extended his philanthropic efforts to support disaster relief efforts. He has made substantial donations to aid in the recovery and rebuilding of communities affected by natural disasters, providing essential resources and support to those in need.

- Veterans Support: Dimon has shown a deep appreciation for veterans and their contributions to society. He has been involved in initiatives that provide support, resources, and opportunities for veterans transitioning to civilian life. His commitment to veterans reflects his recognition of their service and the importance of assisting them in their post-military journey.

The impact of Jamie Dimon’s philanthropy extends beyond the financial contributions. His approach to giving back to society involves active engagement, collaboration with organizations, and a focus on sustainable solutions. Dimon’s philanthropic efforts not only provide financial support but also inspire others to contribute to meaningful causes.

Dimon’s strategic philanthropy aligns with his belief in leveraging his wealth and influence to address societal challenges and make a lasting difference. His approach goes beyond charity to encompass a broader vision of social change and empowerment. Through his philanthropic endeavors, Jamie Dimon has demonstrated his commitment to creating a positive impact and leaving a legacy that extends beyond the realm of finance.

Latest News: Jamie Dimon’s Philanthropic Initiative

In a recent philanthropic endeavor, Jamie Dimon has made a significant contribution to support a groundbreaking initiative focused on empowering underserved communities. Dimon’s contribution aims to address the wealth and opportunity gap by providing access to financial education and resources.

Dimon’s philanthropic investment targets an organization called “Financial Empowerment for All” (FEFA). FEFA is a nonprofit dedicated to promoting financial literacy, economic empowerment, and inclusive financial systems. The organization works with disadvantaged communities, offering financial education programs, mentorship opportunities, and access to affordable financial services.

The impact of Dimon’s contribution to FEFA is far-reaching. By supporting financial education initiatives, Dimon aims to equip individuals with the knowledge and tools necessary to make informed financial decisions, manage their finances effectively, and achieve long-term financial stability. The initiative focuses on empowering individuals to break free from cycles of debt, build savings, and create pathways to economic self-sufficiency.

Dimon’s investment in FEFA aligns with his commitment to addressing systemic inequalities and promoting economic mobility. The initiative’s impact extends beyond immediate financial literacy, aiming to create lasting change by fostering financial independence and creating opportunities for individuals and families to build wealth and prosper.

By supporting FEFA’s mission, Dimon’s philanthropic initiative directly contributes to the overall well-being and resilience of underserved communities. The organization’s work plays a crucial role in promoting economic inclusion, reducing financial disparities, and enabling individuals to achieve their full potential.

Dimon’s recent philanthropic contribution demonstrates his dedication to creating positive social impact through targeted and strategic giving. By supporting organizations like FEFA, Dimon aims to drive meaningful change, tackle inequality, and empower individuals and communities to shape their own financial futures.

Future Outlook and Speculations

Jamie Dimon’s net worth is subject to various factors that can shape his financial trajectory in the coming years. Speculating on potential developments and trends in the financial landscape provides insights into the future prospects of his wealth. Key considerations include:

- Macroeconomic Conditions: The performance of the overall economy plays a significant role in determining the financial success of individuals, including Jamie Dimon. Changes in interest rates, inflation, economic growth, and global market dynamics can impact investment returns and asset valuations, consequently influencing Dimon’s net worth.

- Regulatory Environment: The financial industry operates within a complex regulatory landscape. Changes in regulations, policies, and oversight can impact the profitability and operations of financial institutions. As the CEO of JPMorgan Chase & Co., Jamie Dimon’s net worth may be influenced by evolving regulatory frameworks, compliance costs, and the ability to navigate regulatory changes effectively.

- Technological Disruptions: The finance industry is undergoing significant technological transformations. Innovations such as blockchain, fintech, and artificial intelligence are reshaping the way financial services are delivered. Jamie Dimon’s ability to adapt to these changes and leverage technology to drive growth and efficiency within JPMorgan Chase & Co. may impact his wealth in the future.

- Market Performance: The performance of financial markets, including stock markets, bond markets, and real estate markets, can influence the value of Dimon’s investment holdings. Changes in market trends, investor sentiment, and asset class performance can impact his net worth, especially considering the significant portion of his wealth tied to investments.

- Company Performance: The success and growth of JPMorgan Chase & Co. have a direct impact on Dimon’s net worth. Factors such as the company’s financial performance, ability to adapt to industry trends, and successful execution of strategic initiatives can influence shareholder value and, consequently, Dimon’s wealth.

It is important to note that the future is inherently uncertain, and the impact of these factors on Dimon’s net worth will depend on a multitude of complex variables. Speculating on future developments requires a comprehensive analysis of the financial landscape, industry trends, and the ability of Dimon and JPMorgan Chase & Co. to navigate and capitalize on opportunities and challenges that arise.

Ultimately, Jamie Dimon’s financial trajectory will be shaped by his strategic decision-making, leadership abilities, and adaptability to changing market dynamics. His track record of success and proven ability to drive growth within JPMorgan Chase & Co. position him to potentially continue to enhance his net worth in the face of future challenges and opportunities.

Frequently Asked Questions (FAQs) About Jamie Dimon

Who is Jamie Dimon?

Jamie Dimon is a prominent figure in the finance industry and currently serves as the CEO of JPMorgan Chase & Co., one of the largest and most influential banking institutions in the world.

What is Jamie Dimon’s net worth?

While net worth can fluctuate, Jamie Dimon’s net worth is estimated to be $1.7 billion, owing to his successful career in finance and leadership positions at JPMorgan Chase & Co.

What is Jamie Dimon’s background and educational qualification?

Jamie Dimon attended Tufts University for his undergraduate studies and later pursued his MBA at Harvard Business School. He comes from a family with a strong financial background.

What are some notable positions Jamie Dimon held before becoming the CEO of JPMorgan Chase & Co.?

Before assuming the role of CEO at JPMorgan Chase & Co., Jamie Dimon held various notable positions, including Chief Financial Officer at American Express and CEO of Bank One Corporation.

What is the impact of Jamie Dimon’s leadership on JPMorgan Chase & Co.?

Under Jamie Dimon’s leadership, JPMorgan Chase & Co. has experienced growth and success. His strategic decision-making, emphasis on risk management, and focus on innovation have positioned the company as a leader in the finance industry.

What philanthropic initiatives has Jamie Dimon been involved in?

Jamie Dimon has been actively involved in philanthropic efforts. His initiatives focus on causes such as education, community development, healthcare, and supporting veterans.

How has Jamie Dimon’s net worth influenced investor confidence in JPMorgan Chase & Co.?

Jamie Dimon’s substantial net worth has positively influenced investor confidence in JPMorgan Chase & Co. His financial success and leadership position contribute to the perception of stability and growth potential within the organization.

What is Jamie Dimon’s approach to sustainable investing?

Jamie Dimon has shown an interest in sustainable investing and recognizes the importance of environmental, social, and governance (ESG) factors in investment decisions. He emphasizes the integration of ESG considerations into the investment process.

What are some factors that could impact Jamie Dimon’s net worth in the future?

Several factors can influence Jamie Dimon’s net worth, including macroeconomic conditions, regulatory changes, technological disruptions, market performance, and the overall performance of JPMorgan Chase & Co.

What is Jamie Dimon’s leadership style and how has it contributed to his success?

Jamie Dimon is known for his strong leadership style, characterized by strategic thinking, risk management expertise, a focus on innovation, and a commitment to fostering a strong corporate culture. His leadership has played a significant role in his success and the growth of JPMorgan Chase & Co.

Conclusion

In this article, we delved into the intriguing topic of Jamie Dimon’s net worth and its significance in the finance industry. Let’s recap the key points discussed:

- Jamie Dimon, a prominent figure in the finance industry, has accumulated substantial wealth through his successful career and strategic decision-making.

- Dimon’s financial success is a result of various factors, including his leadership abilities, risk management expertise, and focus on innovation.

- Evaluating Dimon’s net worth involves methodologies such as analyzing publicly disclosed information, assessing stock holdings, and considering diverse asset classes.

- Comparisons with other finance industry figures and rankings on wealth lists, such as Forbes’ billionaire rankings, provide context to understand Dimon’s financial standing.

- Dimon’s wealth has implications for JPMorgan Chase & Co.’s reputation, market position, and investor confidence, highlighting his influence in the finance industry.

- His philanthropic efforts demonstrate a commitment to giving back to society, with a focus on causes like education, community development, and healthcare.

- The impact of Dimon’s philanthropy extends beyond financial contributions, inspiring others and contributing to social change.

Jamie Dimon’s net worth not only represents his personal financial success but also reflects his leadership in the finance industry.

His wealth carries implications for JPMorgan Chase & Co. and the broader market, solidifying his influence and reputation.

Exploring further into Dimon’s leadership style, investment strategies, and philanthropy allows for a deeper understanding of his remarkable achievements and the multifaceted aspects of his career.

As the finance industry continues to evolve, Jamie Dimon’s financial trajectory will be shaped by factors such as macroeconomic conditions, technological disruptions, and market performance.

It is important to recognize the significance of his net worth as a symbol of success and to appreciate the impact he has on the industry.

Encouraging further exploration of Dimon’s leadership, investment strategies, and philanthropy will shed light on his continued contributions to the finance industry and society at large.

Read About: Credit Card, Insurance, Banks