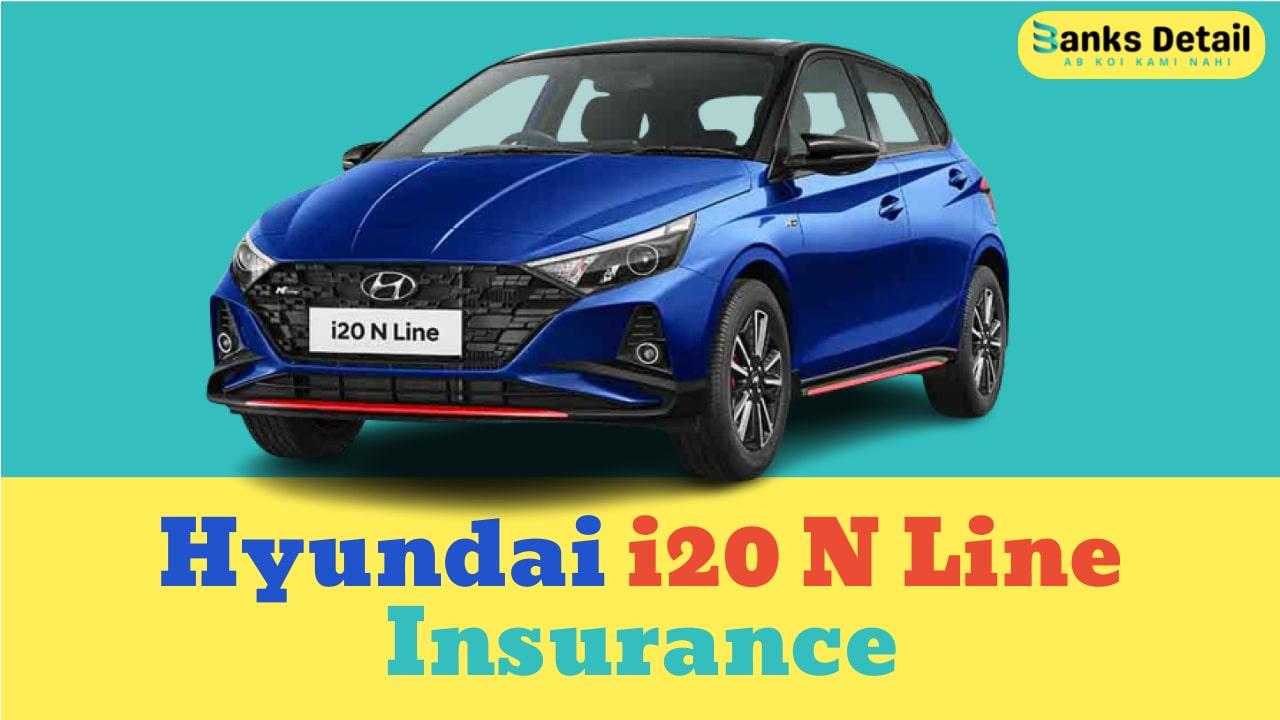

Hyundai i20 N Line Insurance: Get the Best Rates Online

The Hyundai i20 N Line is a high-performance hatchback that is sure to turn heads. With its sporty design and powerful engine, it’s no wonder that the i20 N Line is a popular choice for drivers who love to drive.

But as a high-performance car, the i20 N Line is also more expensive to insure than a regular i20. That’s why it’s important to get the best insurance rates possible for your i20 N Line.

In this article, we’ll discuss the different types of insurance coverage available for the Hyundai i20 N Line, as well as some tips on how to get the best rates.

What is the Hyundai i20 N Line?

The Hyundai i20 N Line is a high-performance hatchback that was launched in India in 2021. It is powered by a 1.0L turbocharged engine that produces 120 horsepower.

The i20 N Line is also equipped with a number of features that make it a fun and exciting car to drive, such as a sport-tuned suspension and a limited-slip differential.

Why is it important to have insurance for the Hyundai i20 N Line?

Insurance is important for any car, but it’s especially important for a high-performance car like the Hyundai i20 N Line. This is because high-performance cars are more likely to be involved in accidents, and they can also be more expensive to repair.

Insurance can help to protect you financially in the event of an accident. It can also help to pay for the cost of repairs if your car is damaged by something other than an accident, such as theft or vandalism.

What are the different types of insurance coverage available for the Hyundai i20 N Line?

There are a number of different types of insurance coverage available for the Hyundai i20 N Line. The most common types of coverage include:

- Comprehensive coverage: This type of coverage protects your car from damage caused by things like theft, fire, and vandalism.

- Collision coverage: This type of coverage protects your car from damage caused by accidents.

- Uninsured motorist coverage: This type of coverage protects you if you are hit by an uninsured driver.

- Medical payments coverage: This type of coverage pays for your medical expenses if you are injured in an accident, regardless of who is at fault.

- Rental reimbursement coverage: This type of coverage pays for the cost of renting a car if your car is in the shop for repairs.

You can choose the type of coverage that best meets your needs and budget.

How to get the best insurance rates for the Hyundai i20 N Line?

There are a few things you can do to get the best insurance rates for your Hyundai i20 N Line:

- Shop around and compare quotes from different insurance companies. This is the best way to ensure that you are getting the best possible rates. You can use online comparison tools or get quotes directly from insurance companies.

- Get quotes online or over the phone. You can often get lower rates if you get quotes online or over the phone.

- Consider your driving history and other factors that may affect your rates. Your driving history, age, the type of coverage you choose, and the make and model of your car can all affect your rates.

- Buy in bulk or bundle your insurance with other policies. You can often get discounts if you buy your insurance in bulk or bundle it with other policies, such as your home insurance.

- Ask about discounts for things like good student discounts or anti-theft devices. Many insurance companies offer discounts for things like good student discounts or anti-theft devices.

- Be a safe driver. The safest drivers get the best rates. So, drive safely and avoid accidents and traffic violations.

Here are some additional tips that you can consider:

- Take a defensive driving course. This can help you improve your driving skills and qualify for a discount on your insurance.

- Install an anti-theft device. This can also help you qualify for a discount on your insurance.

- Maintain a good credit score. A good credit score can also help you qualify for lower rates.

- Pay your insurance premiums on time. This can help you build a good payment history and qualify for lower rates in the future.

Frequently Asked Questions About Hyundai i20 N Line Insurance

What is the average cost of insurance for a Hyundai i20 N Line?

The average cost of insurance for a Hyundai i20 N Line is around Rs. 25,000 per year. However, the actual cost will vary depending on a number of factors, including your driving history, age, the type of coverage you choose, the make and model of your car, and your location.

What are the most important factors that affect insurance rates for a Hyundai i20 N Line?

The most important factors that affect insurance rates for a Hyundai i20 N Line are:

Your driving history: Drivers with a clean driving history will typically get lower rates than drivers with a history of accidents or traffic violations.

Your age: Younger drivers are typically considered to be at higher risk than older drivers, so they will typically pay higher rates.

The type of coverage you choose: The more coverage you choose, the higher your rates will be.

The make and model of your car: Some cars are more expensive to insure than others. High-performance cars, like the Hyundai i20 N Line, are typically more expensive to insure because they are more likely to be involved in accidents.

Your location: The cost of insurance can vary depending on where you live. Cars that are driven in areas with high crime rates or high traffic accident rates will typically be more expensive to insure.

What is the difference between comprehensive and collision coverage?

Comprehensive coverage protects your car from damage caused by things like theft, fire, and vandalism. Collision coverage protects your car from damage caused by accidents.

What is uninsured motorist coverage?

Uninsured motorist coverage protects you if you are hit by an uninsured driver. This type of coverage can help pay for your medical expenses, property damage, and lost wages if you are injured in an accident caused by an uninsured driver.

What is gap insurance?

Gap insurance covers the difference between the amount you owe on your car loan and the amount your car is worth if it is totaled. This type of insurance can be helpful if you have a loan on your car and it is totaled in an accident.

Conclusion

Getting the best insurance rates for your Hyundai i20 N Line takes a little bit of effort, but it is worth it to save money. By following the tips in this article, you can get the best possible deal on your insurance.

Here are some of the key things to remember:

- Compare quotes from different insurance companies. This is the best way to ensure that you are getting the best possible rates.

- Consider your driving history and other factors that may affect your rates. Your driving history, age, and the type of coverage you choose can all affect your rates.

- Buy in bulk or bundle your insurance with other policies. You can often get discounts if you buy your insurance in bulk or bundle it with other policies, such as your home insurance.

- Ask about discounts for things like good student discounts or anti-theft devices. Many insurance companies offer discounts for things like good student discounts or anti-theft devices.

By following these tips, you can get the best insurance rates for your Hyundai i20 N Line and save money.

Read More About:- Insurance, Car Insurance, Hyundai, Hyundai i20 N Line